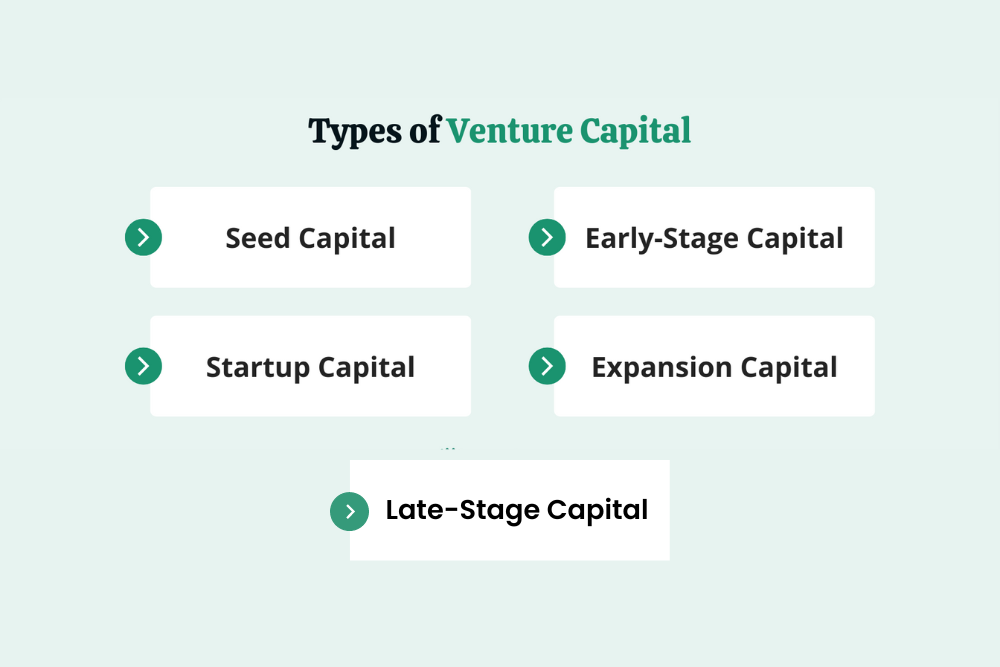

Venture capital firms play a pivotal role in fueling innovation and growth by providing funding to startups and emerging companies. However, not all venture capital firms operate in the same way. They vary significantly in their investment strategies, focus areas, and stages of involvement. Understanding the different types of venture capital firms is essential for entrepreneurs seeking funding and investors looking to align with the right partners. From early-stage seed investors to late-stage growth funds, each type serves a unique purpose in the entrepreneurial ecosystem. This article explores the diverse landscape of venture capital firms, shedding light on their distinct roles and contributions to the business world.

What Are the Different Types of Venture Capital Firms?

Venture capital firms play a crucial role in funding startups and high-growth companies. These firms vary in their investment strategies, stages of funding, and industry focus. Understanding the different types of venture capital firms can help entrepreneurs identify the right investors for their business needs.

1. Early-Stage Venture Capital Firms

Early-stage venture capital firms focus on investing in startups during their initial phases, such as seed or Series A rounds. These firms provide capital to help businesses develop their products, build teams, and establish market presence. They often take higher risks but seek significant returns if the startup succeeds. Examples include Sequoia Capital and Andreessen Horowitz.

See Also How Many Universities Have Venture Capital Funds and Which Ones Are Most Prominent

How Many Universities Have Venture Capital Funds and Which Ones Are Most Prominent2. Late-Stage Venture Capital Firms

Late-stage venture capital firms invest in more established companies that have proven business models and are scaling rapidly. These firms typically participate in Series B, C, or later funding rounds. Their investments are less risky compared to early-stage funding, as the companies are closer to profitability or an IPO. Examples include Tiger Global Management and SoftBank Vision Fund.

3. Sector-Specific Venture Capital Firms

Sector-specific venture capital firms specialize in particular industries, such as technology, healthcare, or clean energy. These firms bring deep industry expertise and networks, which can be invaluable for startups in those sectors. For instance, Khosla Ventures focuses on technology and sustainability, while OrbiMed specializes in healthcare.

4. Corporate Venture Capital Firms

Corporate venture capital (CVC) firms are investment arms of large corporations. They invest in startups that align with their parent company's strategic goals, such as innovation or market expansion. CVCs often provide not only funding but also access to resources, mentorship, and partnerships. Examples include Google Ventures (GV) and Intel Capital.

See Also What is the TechStars interview process like?How many rounds are there, and when are decisions released?

What is the TechStars interview process like?How many rounds are there, and when are decisions released?5. Micro Venture Capital Firms

Micro venture capital firms focus on smaller investments, typically in the range of $50,000 to $500,000. They often support very early-stage startups or niche markets. These firms are ideal for entrepreneurs who need smaller amounts of capital to get started. Examples include 500 Startups and Y Combinator.

| Type of Firm | Investment Stage | Examples |

|---|---|---|

| Early-Stage | Seed, Series A | Sequoia Capital, Andreessen Horowitz |

| Late-Stage | Series B, C, and beyond | Tiger Global Management, SoftBank Vision Fund |

| Sector-Specific | Varies by industry | Khosla Ventures, OrbiMed |

| Corporate Venture Capital | Strategic alignment | Google Ventures, Intel Capital |

| Micro Venture Capital | Very early-stage | 500 Startups, Y Combinator |

Understanding the Key Categories of Venture Capital Firms

1. Early-Stage Venture Capital Firms

Early-stage venture capital firms focus on investing in startups and emerging companies that are in the initial phases of their development. These firms typically provide seed funding or Series A funding to help businesses develop their products, build their teams, and establish a market presence. Early-stage investors often take on higher risks because the companies they invest in have limited operating histories and unproven business models. However, the potential for high returns is significant if the startup succeeds. These firms also offer mentorship, strategic guidance, and industry connections to help startups navigate the challenges of scaling their operations.

2. Growth-Stage Venture Capital Firms

Growth-stage venture capital firms target companies that have already demonstrated market traction and are looking to scale their operations. These firms typically invest in Series B or Series C funding rounds, where the focus is on expanding market reach, increasing production capacity, or entering new markets. Unlike early-stage investors, growth-stage firms invest in companies with proven business models and steady revenue streams. Their goal is to accelerate growth and prepare the company for an eventual exit strategy, such as an IPO or acquisition. These firms often bring operational expertise and industry networks to help companies achieve their growth objectives.

See Also What Are Secondary Investments in Venture Capital What Are the Benefits

What Are Secondary Investments in Venture Capital What Are the Benefits3. Late-Stage Venture Capital Firms

Late-stage venture capital firms invest in mature companies that are close to achieving profitability or are already profitable. These firms typically participate in Series D or later funding rounds, where the focus is on scaling globally, optimizing operations, or preparing for a public offering. Late-stage investors are less concerned with product development and more focused on financial engineering and market expansion. They often provide bridge financing to help companies reach their next milestone, such as an IPO. While the risk is lower compared to early-stage investments, the potential returns are also more modest.

4. Corporate Venture Capital Firms

Corporate venture capital (CVC) firms are subsidiaries of large corporations that invest in startups and emerging companies. These firms aim to leverage innovation from external sources to complement their parent company's core business. Unlike traditional venture capital firms, CVCs often prioritize strategic alignment over financial returns. They invest in startups that can provide technological advancements, market insights, or competitive advantages to the parent company. CVCs also offer startups access to the parent company's resources, distribution channels, and customer base, which can be invaluable for growth.

5. Sector-Specific Venture Capital Firms

Sector-specific venture capital firms specialize in investing in particular industries or technologies, such as healthcare, fintech, clean energy, or artificial intelligence. These firms have deep expertise in their chosen sectors and often provide domain-specific guidance to the companies they invest in. By focusing on a specific industry, these firms can identify emerging trends and high-potential opportunities more effectively than generalist investors. They also bring industry connections and technical knowledge that can help startups overcome sector-specific challenges and achieve market leadership.

See AlsoFrequently Asked Questions from Our Community

What are the main types of venture capital firms?

Venture capital firms can be broadly categorized into several types based on their focus and investment strategies. Early-stage venture capital firms specialize in funding startups in their initial phases, often providing seed or Series A funding. Growth-stage venture capital firms invest in more established companies that are looking to scale operations or expand into new markets. Additionally, there are sector-specific venture capital firms that focus on particular industries, such as technology, healthcare, or clean energy. Lastly, corporate venture capital firms are backed by large corporations and often invest in startups that align with their strategic goals.

How do early-stage venture capital firms differ from growth-stage firms?

Early-stage venture capital firms typically invest in startups that are in the ideation or product development phase. These firms take on higher risks but also have the potential for significant returns if the startup succeeds. In contrast, growth-stage venture capital firms invest in companies that have already demonstrated market traction and are looking to scale. These firms usually provide larger funding rounds, such as Series B or later, and focus on helping companies expand their operations, enter new markets, or improve their infrastructure.

What are sector-specific venture capital firms?

Sector-specific venture capital firms concentrate their investments within a particular industry or niche. For example, some firms may focus exclusively on technology startups, while others might specialize in biotechnology, clean energy, or fintech. These firms often have deep expertise and networks within their chosen sector, allowing them to provide not only capital but also valuable industry insights, mentorship, and connections to help startups succeed.

See Also What Are the Expectations of the Venture Capitalist While Investing in a Startup

What Are the Expectations of the Venture Capitalist While Investing in a StartupWhat is the role of corporate venture capital firms?

Corporate venture capital (CVC) firms are investment arms of large corporations that invest in startups, often with strategic objectives in mind. Unlike traditional venture capital firms, CVCs are not solely focused on financial returns. Instead, they seek to invest in startups that can provide strategic advantages to the parent company, such as access to new technologies, markets, or innovative business models. These investments can also help corporations stay competitive by fostering innovation and staying ahead of industry trends.

Leave a Reply

Our Recommended Articles