Starting a DJ business can be an exciting venture, but it also comes with its share of risks. From equipment damage to potential liability claims, unforeseen events can disrupt your operations and finances. This is where DJ business insurance becomes essential. Understanding the cost of such insurance is crucial for budgeting and ensuring your business is adequately protected. The price of DJ insurance varies depending on factors like coverage type, business size, and location. In this article, we’ll explore the key elements that influence the cost of DJ business insurance and provide insights to help you make informed decisions for your business’s protection.

How Much is a DJ Business Insurance?

DJ business insurance is an essential investment for any professional DJ. It protects against potential risks such as equipment damage, liability claims, and event cancellations. The cost of DJ insurance varies depending on several factors, including coverage type, business size, and location. Below, we break down the key aspects of DJ business insurance costs and what influences them.

1. What Factors Influence the Cost of DJ Business Insurance?

The cost of DJ business insurance is influenced by several factors, including:

- Coverage Type: Basic liability insurance is cheaper than comprehensive plans that include equipment coverage and event cancellation.

- Business Size: Larger DJ businesses with more employees and equipment may pay higher premiums.

- Location: Insurance costs can vary based on regional risks and regulations.

- Claims History: A history of claims may increase premiums.

- Event Types: High-risk events like large festivals may require additional coverage.

Who Are the Top Vcs Angel Investors and Tech Entrepreneurs in the Dc Nova Area

Who Are the Top Vcs Angel Investors and Tech Entrepreneurs in the Dc Nova Area2. What Are the Average Costs of DJ Business Insurance?

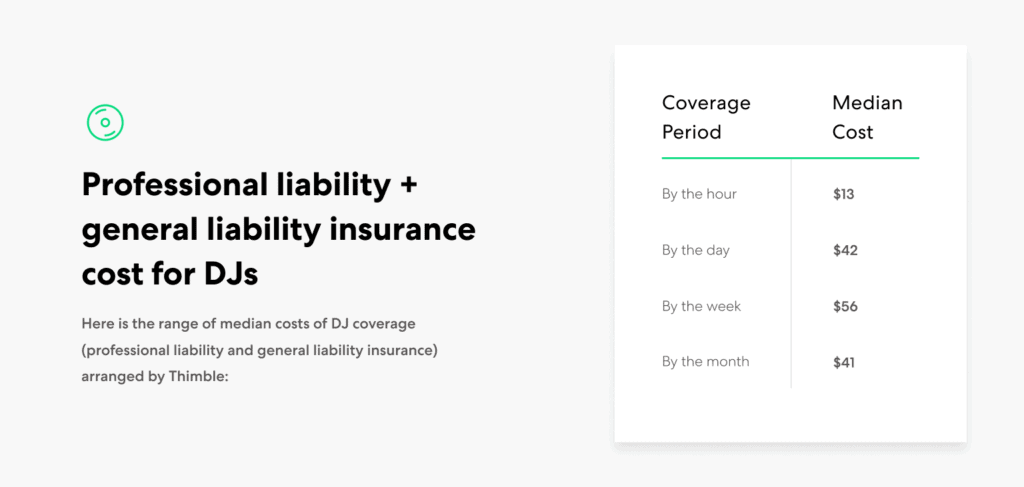

On average, DJ business insurance can range from $150 to $1,000 annually, depending on the factors mentioned above. Here’s a breakdown:

| Coverage Type | Average Annual Cost |

|---|---|

| General Liability | $150 - $500 |

| Equipment Insurance | $200 - $600 |

| Event Cancellation | $100 - $300 |

3. Why is Equipment Insurance Important for DJs?

DJs rely heavily on their equipment, such as mixers, speakers, and microphones. Equipment insurance protects against theft, damage, or loss, ensuring that DJs can continue working without significant financial setbacks. The cost of this coverage depends on the value of the equipment and the level of protection required.

4. How Does Liability Insurance Protect DJs?

Liability insurance is crucial for DJs as it covers legal and medical expenses if a third party is injured or their property is damaged during an event. For example, if a guest trips over a speaker cable, liability insurance can cover the associated costs. This type of insurance typically costs between $150 and $500 annually.

See Also What is the Typical Structure of a Vc Fund?

What is the Typical Structure of a Vc Fund?5. What Additional Coverages Should DJs Consider?

In addition to general liability and equipment insurance, DJs may want to consider:

- Event Cancellation Insurance: Covers lost income if an event is canceled due to unforeseen circumstances.

- Cyber Liability Insurance: Protects against data breaches or cyberattacks if the DJ handles client information online.

- Commercial Auto Insurance: Covers vehicles used for business purposes, such as transporting equipment.

Each of these coverages adds to the overall cost but provides essential protection tailored to specific risks.

How much does DJ insurance cost?

What Are the Hours Like Working as a Vc Associate Pre and Post Mba at the Bigger Firms

What Are the Hours Like Working as a Vc Associate Pre and Post Mba at the Bigger FirmsFactors Influencing DJ Insurance Costs

The cost of DJ insurance varies depending on several factors. These include:

- Coverage Type: Basic liability insurance is cheaper than comprehensive plans that include equipment and event cancellation coverage.

- Event Size: Larger events with higher attendee numbers typically increase insurance costs due to greater risk exposure.

- Location: Insurance costs can vary based on the region or country where the DJ operates, as local regulations and risk levels differ.

Average Cost of DJ Insurance

On average, DJ insurance can range from:

- $150 to $500 annually for basic liability coverage.

- $300 to $1,000 annually for comprehensive plans that include equipment and event-specific coverage.

- Per-event policies may cost between $50 and $200, depending on the event's scale and duration.

Types of DJ Insurance Coverage

DJ insurance typically includes the following types of coverage:

See Also Where Can I Find a Pre Seed and Seed Venture Capital List in the United States

Where Can I Find a Pre Seed and Seed Venture Capital List in the United States- General Liability: Covers third-party injuries or property damage during events.

- Equipment Insurance: Protects against theft, loss, or damage to DJ gear.

- Event Cancellation: Provides reimbursement for lost income due to canceled events.

Why DJs Need Insurance

DJ insurance is essential for several reasons:

- Legal Requirements: Many venues and event organizers require proof of insurance before hiring a DJ.

- Financial Protection: Insurance safeguards against costly lawsuits or equipment replacement expenses.

- Professional Credibility: Having insurance enhances a DJ's reputation and trustworthiness.

How to Save on DJ Insurance

DJs can reduce insurance costs by:

- Comparing Quotes: Obtain multiple quotes from different providers to find the best rates.

- Bundling Policies: Combine liability and equipment coverage for potential discounts.

- Maintaining a Clean Record: A history of no claims can lead to lower premiums.

What insurance do I need as a DJ?

How To Start A Technology Company

How To Start A Technology CompanyWhy Do DJs Need Insurance?

As a DJ, you face various risks, from equipment damage to potential legal claims. Insurance helps protect your business and personal assets. Here are the key reasons why insurance is essential:

- Equipment Protection: Your gear is expensive and vital to your work. Insurance covers theft, damage, or loss.

- Liability Coverage: Protects you if someone is injured or property is damaged during your event.

- Professional Indemnity: Covers legal fees if a client claims your services caused them financial loss.

What Types of Insurance Should a DJ Consider?

Different policies address specific risks. Here are the most important types of insurance for DJs:

- Public Liability Insurance: Covers claims if someone is injured or property is damaged during your performance.

- Equipment Insurance: Protects your gear from theft, damage, or loss, whether at home, in transit, or at a venue.

- Professional Indemnity Insurance: Safeguards against claims of negligence or mistakes in your services.

How Does Public Liability Insurance Benefit DJs?

Public liability insurance is crucial for DJs who perform at events. Here’s why:

- Injury Claims: If a guest trips over your cables and gets hurt, this insurance covers legal fees and compensation.

- Property Damage: If you accidentally damage the venue’s equipment or property, the policy covers repair costs.

- Peace of Mind: Many venues require proof of public liability insurance before allowing you to perform.

Why Is Equipment Insurance Important for DJs?

Your equipment is your livelihood. Equipment insurance ensures you’re protected:

- Theft Coverage: Replaces stolen gear, whether from your vehicle, home, or venue.

- Accidental Damage: Covers repairs or replacements if your equipment is damaged during transport or use.

- Worldwide Protection: Some policies cover your gear even when traveling internationally for gigs.

What Does Professional Indemnity Insurance Cover for DJs?

Professional indemnity insurance protects you from claims related to your services:

- Negligence Claims: Covers legal costs if a client claims your performance caused them financial loss.

- Contract Disputes: Helps resolve issues if a client believes you didn’t meet the agreed terms.

- Defense Costs: Pays for legal representation, even if the claim is unfounded.

How much is a $1 million dollar insurance policy for a business?

Factors Influencing the Cost of a $1 Million Business Insurance Policy

The cost of a $1 million insurance policy for a business depends on several factors. These include:

- Industry Type: High-risk industries like construction or healthcare typically pay higher premiums.

- Business Size: Larger businesses with more employees or higher revenue may face increased costs.

- Location: Businesses in areas prone to natural disasters or with higher crime rates may incur higher premiums.

- Coverage Type: General liability, professional liability, or property insurance each have different pricing structures.

- Claims History: A history of frequent claims can significantly raise the cost of the policy.

Average Cost of a $1 Million Business Insurance Policy

The average cost of a $1 million insurance policy varies widely. For example:

- Small Businesses: Typically pay between $500 and $2,000 annually for general liability coverage.

- Medium-Sized Businesses: May pay between $2,000 and $5,000 annually depending on risk factors.

- High-Risk Industries: Could pay upwards of $10,000 annually due to increased liability exposure.

Types of Coverage Included in a $1 Million Policy

A $1 million insurance policy can include various types of coverage, such as:

- General Liability: Covers third-party injuries, property damage, and advertising injuries.

- Professional Liability: Protects against claims of negligence or errors in professional services.

- Property Insurance: Covers damage to business property due to fire, theft, or natural disasters.

- Workers' Compensation: Provides coverage for employee injuries or illnesses related to work.

How to Reduce the Cost of a $1 Million Business Insurance Policy

Businesses can take steps to lower the cost of a $1 million insurance policy by:

- Implementing Safety Measures: Reducing workplace risks can lead to lower premiums.

- Bundling Policies: Combining multiple types of coverage with one insurer often results in discounts.

- Maintaining a Clean Claims History: Fewer claims can lead to more favorable rates.

- Increasing Deductibles: Opting for higher deductibles can reduce premium costs.

Comparing Quotes for a $1 Million Business Insurance Policy

To find the best deal on a $1 million insurance policy, businesses should:

- Request Multiple Quotes: Compare rates from different insurers to identify the most competitive offer.

- Evaluate Coverage Limits: Ensure the policy provides adequate protection for the business's specific needs.

- Check Insurer Reputation: Research the insurer's financial stability and customer service record.

- Consult an Insurance Broker: A broker can help navigate options and negotiate better terms.

How much should a small business pay for insurance?

Factors Influencing Small Business Insurance Costs

The cost of insurance for a small business depends on several factors. These include:

- Industry type: High-risk industries like construction typically pay more.

- Business size: Larger businesses with more employees often face higher premiums.

- Location: Businesses in areas prone to natural disasters may incur higher costs.

- Coverage type: Comprehensive policies cost more than basic ones.

- Claims history: A history of frequent claims can increase premiums.

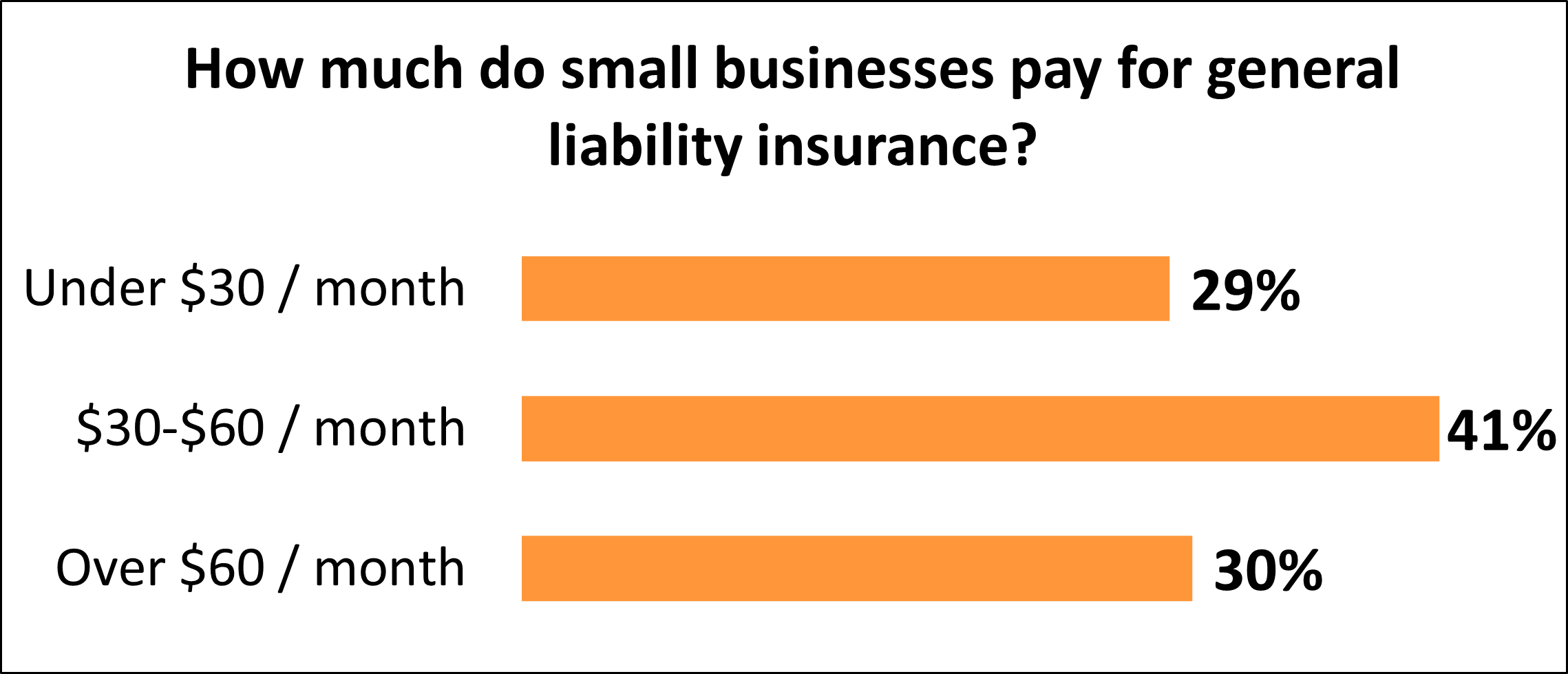

Average Costs of Common Insurance Types

Small businesses typically pay varying amounts depending on the type of insurance:

- General Liability Insurance: $500 to $1,000 annually.

- Professional Liability Insurance: $800 to $2,000 annually.

- Workers' Compensation Insurance: $0.75 to $2.74 per $100 of payroll.

- Commercial Property Insurance: $1,000 to $3,000 annually.

- Business Owner’s Policy (BOP): $1,000 to $3,000 annually.

Ways to Reduce Insurance Costs

Small businesses can take steps to lower their insurance expenses:

- Bundle policies: Opt for a Business Owner’s Policy (BOP) to save on premiums.

- Increase deductibles: Higher deductibles can reduce monthly payments.

- Implement safety measures: Reducing risks can lead to lower premiums.

- Shop around: Compare quotes from multiple providers.

- Review coverage annually: Ensure you’re not over-insured or under-insured.

Importance of Tailored Insurance Coverage

Customizing insurance to fit your business needs is crucial:

- Avoid overpaying: Only pay for the coverage you truly need.

- Protect against specific risks: Tailored policies address unique business vulnerabilities.

- Ensure compliance: Meet industry-specific legal requirements.

- Enhance financial stability: Adequate coverage prevents unexpected financial burdens.

- Improve peace of mind: Knowing your business is protected reduces stress.

Common Mistakes When Choosing Business Insurance

Small businesses often make errors when selecting insurance:

- Underestimating risks: Failing to account for all potential liabilities.

- Choosing the cheapest option: Low-cost policies may lack essential coverage.

- Ignoring policy details: Not reading the fine print can lead to surprises.

- Overlooking industry-specific needs: Generic policies may not cover unique risks.

- Not updating coverage: Failing to adjust policies as the business grows or changes.

Frequently Asked Questions from Our Community

What factors influence the cost of DJ business insurance?

The cost of DJ business insurance depends on several factors, including the type of coverage you choose, the size of your business, and the level of risk associated with your events. For example, a DJ who performs at large-scale events may pay more for insurance than one who works at smaller, low-risk gatherings. Additionally, your location, the value of your equipment, and your claims history can also impact the premium. It's essential to assess your specific needs and risks to determine the most accurate cost.

What types of insurance are typically included in DJ business insurance?

DJ business insurance often includes several types of coverage, such as general liability insurance, which protects against third-party claims for injuries or property damage. Equipment insurance is also common, covering the repair or replacement of your DJ gear in case of theft, loss, or damage. Some policies may also offer professional liability insurance to protect against claims of negligence or mistakes during performances. Depending on your needs, you might also consider additional coverage like event cancellation insurance or workers' compensation if you have employees.

How much does DJ business insurance typically cost?

The cost of DJ business insurance can vary widely, but on average, it ranges from $300 to $1,000 annually. Basic policies with limited coverage may start at the lower end of this range, while comprehensive plans that include multiple types of coverage and higher limits can cost more. For example, a policy that includes general liability, equipment coverage, and professional liability might cost closer to $1,000 per year. It's important to compare quotes from different providers to find a plan that fits your budget and coverage needs.

Can I customize my DJ business insurance policy?

Yes, most insurance providers allow you to customize your DJ business insurance policy to suit your specific needs. You can choose the types of coverage you require, such as general liability, equipment insurance, or professional liability, and adjust the coverage limits to match the value of your assets and the scale of your events. Some providers also offer optional add-ons, like event cancellation insurance or cyber liability coverage, to further tailor your policy. Working with an insurance agent can help you design a plan that provides the right level of protection for your business.

Leave a Reply

Our Recommended Articles