Venture capital (VC) firms have long been pivotal in fueling innovation by investing in startups and high-growth companies. Traditionally, these firms operate as private entities, raising funds from limited partners to deploy into promising ventures. However, as the financial landscape evolves, a growing question emerges: Can VC firms go public? Going public could offer these firms access to broader capital pools, increased liquidity, and enhanced visibility. Yet, it also raises concerns about transparency, regulatory scrutiny, and potential conflicts of interest. This article explores the feasibility, benefits, and challenges of VC firms transitioning to publicly traded entities, shedding light on a potential shift in the venture capital ecosystem.

Can VC Firms Go Public?

What Does It Mean for a VC Firm to Go Public?

When a venture capital (VC) firm goes public, it means that the firm is offering its shares to the public through an initial public offering (IPO). This allows the firm to raise capital from public investors, which can be used to expand its operations, invest in more startups, or strengthen its financial position. Going public also increases the firm's visibility and credibility in the market.

Why Would a VC Firm Consider Going Public?

A VC firm might consider going public for several reasons. First, it provides access to a larger pool of capital, which can be used to fund more investments. Second, it allows the firm's partners and employees to liquidate their equity stakes and realize gains. Third, being a publicly traded company can enhance the firm's reputation and attract more high-quality startups seeking funding.

See Also What is the Future of Venture Capital?

What is the Future of Venture Capital?What Are the Challenges for VC Firms Going Public?

Going public is not without challenges for VC firms. One major issue is the regulatory burden that comes with being a publicly traded company, including compliance with SEC regulations and increased transparency requirements. Additionally, the illiquid nature of VC investments can make it difficult to provide consistent returns to public shareholders. There is also the risk of losing the flexibility and privacy that comes with being a private firm.

Are There Examples of VC Firms That Have Gone Public?

Yes, there are examples of VC firms that have successfully gone public. One notable example is Blackstone Group, which went public in 2007. Another example is KKR & Co., which also transitioned to a public company. These firms have demonstrated that it is possible for VC firms to go public, although it requires careful planning and execution.

What Are the Alternatives to Going Public for VC Firms?

For VC firms that do not wish to go public, there are several alternatives. One option is to raise capital through private equity funds or limited partnerships. Another option is to form special purpose acquisition companies (SPACs) to raise funds without going through a traditional IPO. Additionally, VC firms can explore secondary markets to allow early investors and employees to sell their shares.

See Also What Are the Pros/cons of the Different Vc Exit Strategies?

What Are the Pros/cons of the Different Vc Exit Strategies?| Key Aspect | Description |

|---|---|

| IPO | Initial Public Offering, a process through which a private company offers shares to the public. |

| Regulatory Burden | Increased compliance and transparency requirements for publicly traded companies. |

| Liquidity | The ability to convert investments into cash, which can be challenging for VC firms. |

| Private Equity Funds | An alternative to going public, where capital is raised from private investors. |

| SPACs | Special Purpose Acquisition Companies, used to raise funds without a traditional IPO. |

Are venture capital firms publicly traded?

Are Venture Capital Firms Publicly Traded?

Most venture capital firms are not publicly traded. They are typically structured as private partnerships or limited liability companies (LLCs), which means they are not listed on public stock exchanges. Instead, they raise funds from institutional investors, high-net-worth individuals, and other private entities. However, there are exceptions where some firms or their parent companies may be publicly traded.

- Private Structure: Venture capital firms are usually private entities, avoiding the regulatory requirements of public companies.

- Funding Sources: They rely on private investors rather than public stock offerings.

- Exceptions: Some firms, like Blackstone or KKR, have publicly traded subsidiaries or parent companies.

Why Are Most Venture Capital Firms Private?

The private nature of venture capital firms allows them to operate with greater flexibility and confidentiality. Being private enables them to focus on long-term investments without the pressure of quarterly earnings reports. Additionally, it helps them maintain a close relationship with their investors, who are often sophisticated and patient.

See Also What Advice Would You Give a Former Startup Product Manager and Product Designer Looking to Get Into Venture Capital as an Associate

What Advice Would You Give a Former Startup Product Manager and Product Designer Looking to Get Into Venture Capital as an Associate- Flexibility: Private firms can make decisions without public scrutiny.

- Confidentiality: They can keep their investments and strategies private.

- Long-Term Focus: They are not pressured by short-term market expectations.

Can You Invest in Venture Capital Firms Indirectly?

Yes, you can invest in venture capital firms indirectly through publicly traded entities that have exposure to venture capital. For example, some private equity firms or business development companies (BDCs) are publicly traded and invest in startups or venture capital funds.

- Publicly Traded PE Firms: Companies like Blackstone or KKR offer exposure to venture capital.

- BDCs: These companies often invest in startups and small businesses.

- Mutual Funds: Some mutual funds include venture capital investments in their portfolios.

What Are the Advantages of Publicly Traded Venture Capital Firms?

Publicly traded venture capital firms or their parent companies offer liquidity and transparency to investors. They also provide an opportunity for retail investors to participate in venture capital, which is typically reserved for accredited investors.

- Liquidity: Shares can be bought and sold on public exchanges.

- Transparency: Public firms are required to disclose financial information.

- Accessibility: Retail investors can invest without meeting high net worth requirements.

What Are the Risks of Investing in Publicly Traded Venture Capital Firms?

Investing in publicly traded venture capital firms carries risks such as market volatility, regulatory changes, and the inherent risks of startup investments. These firms may also face conflicts of interest between public shareholders and private investors.

See Also What Types of Businesses Do Venture Capitalists Prefer to Invest in

What Types of Businesses Do Venture Capitalists Prefer to Invest in- Market Volatility: Share prices can fluctuate significantly.

- Regulatory Risks: Changes in laws can impact operations.

- Startup Risks: Investments in startups are inherently risky and may fail.

Is venture capital always private equity?

What is Venture Capital?

Venture capital (VC) is a form of private equity financing that is provided by investors to startups and small businesses with high growth potential. Unlike traditional private equity, venture capital typically focuses on early-stage companies that are in the initial phases of development. Here are some key points:

- High-risk, high-reward: VC investments are considered high-risk due to the uncertainty of success in early-stage companies.

- Equity stake: In exchange for funding, venture capitalists usually receive an equity stake in the company.

- Active involvement: VCs often provide mentorship and strategic guidance to help the company grow.

What is Private Equity?

Private equity (PE) refers to investments made in private companies or the acquisition of public companies to delist them from stock exchanges. Private equity firms typically invest in more mature companies compared to venture capital. Key aspects include:

See Also How Are Hours Like When You Work for a Vc is There a Work Life Balance

How Are Hours Like When You Work for a Vc is There a Work Life Balance- Diverse investments: PE can include buyouts, growth capital, and distressed investments.

- Long-term focus: Private equity investments are usually held for several years to improve the company’s value before exiting.

- Larger deals: PE deals often involve larger sums of money compared to venture capital.

Is Venture Capital a Subset of Private Equity?

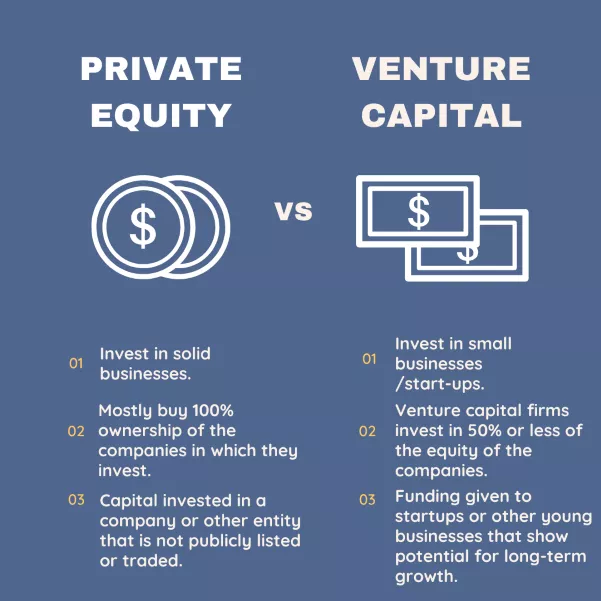

Yes, venture capital is considered a subset of private equity. Both involve investing in private companies, but they differ in terms of the stage of the companies they target and the level of risk involved. Here’s how they compare:

- Stage of investment: VC focuses on early-stage companies, while PE targets more established businesses.

- Risk profile: VC is generally riskier due to the unproven nature of startups.

- Investment size: PE deals are typically larger in scale compared to VC investments.

Key Differences Between Venture Capital and Private Equity

While both venture capital and private equity involve investing in private companies, there are significant differences between the two. These differences include:

- Target companies: VC invests in startups and early-stage companies, whereas PE invests in mature companies.

- Investment size: VC investments are generally smaller, while PE deals involve larger amounts of capital.

- Risk and return: VC carries higher risk but offers the potential for higher returns, while PE focuses on steady growth and profitability.

Can Venture Capital Be Considered Private Equity?

Yes, venture capital can be considered a specialized form of private equity. Both involve investing in private companies, but VC is specifically tailored to early-stage, high-growth potential businesses. Here’s why:

- Similar structure: Both VC and PE involve raising funds from investors to acquire equity in private companies.

- Exit strategies: Both aim to exit their investments through IPOs or acquisitions to generate returns.

- Overlap in goals: Both seek to increase the value of their investments over time, though their methods and timelines differ.

Can private equity firms go public?

What Does It Mean for a Private Equity Firm to Go Public?

When a private equity firm goes public, it means the firm transitions from being privately held to offering its shares to the general public through an Initial Public Offering (IPO). This allows the firm to raise capital from public investors and increases its visibility in the market. However, it also subjects the firm to greater regulatory scrutiny and public disclosure requirements.

- Capital Raising: Going public provides access to a larger pool of capital from public investors.

- Increased Transparency: Public firms must disclose financial and operational details regularly.

- Market Valuation: The firm's value is determined by the stock market, which can fluctuate based on performance and market conditions.

Why Would a Private Equity Firm Choose to Go Public?

Private equity firms may decide to go public for several reasons, including the need for additional capital to fund acquisitions or expand operations. Going public can also enhance the firm's reputation and provide liquidity for existing shareholders.

- Funding Growth: Public markets offer a significant source of funding for expansion.

- Liquidity for Stakeholders: Shareholders can sell their shares on the open market.

- Brand Recognition: Being publicly traded can increase the firm's credibility and visibility.

Challenges Faced by Private Equity Firms Going Public

While going public offers benefits, it also comes with challenges such as regulatory compliance, increased scrutiny, and the pressure to deliver consistent returns to shareholders. These factors can impact the firm's operations and decision-making processes.

- Regulatory Burden: Public firms must adhere to strict reporting and compliance standards.

- Market Pressure: Shareholders expect consistent performance, which can limit long-term strategies.

- Loss of Control: Founders and management may lose some control over the firm's direction.

Examples of Private Equity Firms That Have Gone Public

Several prominent private equity firms have successfully gone public, including The Blackstone Group, KKR & Co., and Apollo Global Management. These firms have demonstrated that it is possible to balance the demands of public markets while maintaining their core investment strategies.

- The Blackstone Group: Went public in 2007, raising $4.1 billion in its IPO.

- KKR & Co.: Transitioned to a public listing in 2010 through a merger with its European affiliate.

- Apollo Global Management: Completed its IPO in 2011, raising $565 million.

How Going Public Affects Private Equity Operations

Going public can significantly alter how a private equity firm operates. The need to meet quarterly earnings expectations and maintain shareholder confidence can influence investment decisions and risk management strategies.

- Focus on Short-Term Results: Public firms often prioritize short-term performance to satisfy shareholders.

- Increased Accountability: Management must justify decisions to a broader audience, including analysts and investors.

- Operational Changes: The firm may need to adopt new governance structures and reporting systems.

Can you invest in VC firms?

What Are Venture Capital (VC) Firms?

Venture Capital (VC) firms are investment companies that provide funding to startups and early-stage businesses with high growth potential. These firms typically invest in exchange for equity, meaning they own a portion of the company. VC firms play a crucial role in fostering innovation and supporting entrepreneurs.

- VC firms focus on high-risk, high-reward investments.

- They often invest in technology, healthcare, and fintech sectors.

- VC firms provide not only capital but also mentorship and strategic guidance.

Can Individuals Invest in VC Firms?

Yes, individuals can invest in VC firms, but it typically requires significant capital and access to exclusive investment opportunities. Most VC firms cater to institutional investors or high-net-worth individuals. However, there are ways for smaller investors to participate indirectly.

- Accredited investors often have direct access to VC funds.

- Some platforms allow crowdfunding for venture capital investments.

- Investing through venture capital ETFs or mutual funds is another option.

How Do VC Firms Generate Returns?

VC firms generate returns by investing in startups that eventually go public or are acquired by larger companies. The goal is to achieve a significant return on investment (ROI) through equity appreciation. However, this process can take several years and involves substantial risk.

- Returns are realized through IPOs or acquisitions.

- VC firms often hold investments for 5-10 years before exiting.

- Only a small percentage of startups succeed, making diversification crucial.

What Are the Risks of Investing in VC Firms?

Investing in VC firms carries significant risks, including the potential loss of capital. Startups are inherently risky, and many fail to achieve profitability. Additionally, VC investments are illiquid, meaning your money may be tied up for years.

- High failure rates among startups are a major risk.

- Investments are illiquid and cannot be easily sold.

- Market volatility and economic downturns can impact returns.

What Are the Alternatives to Direct VC Investment?

If direct investment in VC firms is not feasible, there are alternative ways to gain exposure to venture capital. These include investing in publicly traded VC-backed companies, venture capital ETFs, or platforms that pool smaller investments into larger funds.

- Invest in publicly traded companies backed by VC firms.

- Consider venture capital ETFs for diversified exposure.

- Use crowdfunding platforms to invest in startups indirectly.

Frequently Asked Questions from Our Community

Can venture capital firms go public?

Yes, venture capital firms can go public, although it is relatively uncommon compared to other types of businesses. When a venture capital firm decides to go public, it typically means that the firm is offering shares of its ownership to the public through an initial public offering (IPO). This allows the firm to raise capital from a broader range of investors, which can be used to expand its operations, invest in more startups, or strengthen its financial position. However, going public also comes with increased regulatory scrutiny and the need to meet the expectations of public shareholders.

What are the benefits of a venture capital firm going public?

The primary benefit of a venture capital firm going public is access to a larger pool of capital. By issuing shares to the public, the firm can raise significant funds to invest in high-growth startups or diversify its portfolio. Additionally, going public can enhance the firm's brand visibility and credibility, making it more attractive to both entrepreneurs seeking funding and institutional investors. Publicly traded venture capital firms may also benefit from increased liquidity, as their shares can be bought and sold on the stock market, providing flexibility for investors and the firm itself.

What are the challenges venture capital firms face when going public?

One of the main challenges for venture capital firms going public is the increased regulatory and compliance requirements. Public companies are subject to strict reporting standards, which can be time-consuming and costly. Additionally, the firm's investment decisions may come under greater scrutiny from shareholders, potentially limiting its ability to take risks or make long-term investments. Another challenge is the potential conflict between the firm's traditional focus on private equity investments and the need to deliver consistent returns to public shareholders, which can create pressure to prioritize short-term gains over long-term growth.

Are there examples of venture capital firms that have gone public?

Yes, there are notable examples of venture capital firms that have successfully gone public. One prominent example is Blackstone Group, which, although primarily known as a private equity firm, has significant venture capital operations and went public in 2007. Another example is KKR & Co., which also transitioned to a publicly traded company. These firms have demonstrated that it is possible for venture capital and private equity firms to navigate the complexities of public markets while maintaining their core investment strategies. However, such cases remain relatively rare in the industry.

Leave a Reply

Our Recommended Articles