Private equity firms and venture capital firms are both key players in the investment world, yet they operate in distinct ways and target different types of businesses. While both provide funding to companies, private equity firms typically invest in established, mature businesses seeking growth or restructuring, often acquiring significant ownership stakes. In contrast, venture capital firms focus on early-stage or high-growth startups with high potential but higher risk. Understanding the differences between these two investment models is crucial for entrepreneurs and investors alike, as each offers unique opportunities, risks, and strategies tailored to specific stages of a company’s lifecycle.

- What is the Difference Between a Private Equity Firm and a Venture Capital Firm?

- Understanding the Core Differences Between Private Equity and Venture Capital Firms

- Frequently Asked Questions from Our Community

- What is the main difference between private equity and venture capital firms?

- How do private equity and venture capital firms differ in terms of risk?

- What is the typical investment size for private equity versus venture capital?

- How do private equity and venture capital firms differ in their involvement with portfolio companies?

What is the Difference Between a Private Equity Firm and a Venture Capital Firm?

Private equity firms and venture capital firms are both involved in investing in companies, but they differ significantly in their approach, target companies, and investment strategies. Understanding these differences is crucial for entrepreneurs and investors alike.

1. Investment Stage

Private equity firms typically invest in established companies that are looking for growth, restructuring, or an exit strategy. These companies are often mature and generate steady cash flows. On the other hand, venture capital firms focus on early-stage companies or startups with high growth potential but may not yet be profitable.

See Also How much money does a techstar mentor make?

How much money does a techstar mentor make?2. Size of Investment

Private equity investments are generally larger in size, often involving hundreds of millions or even billions of dollars. Venture capital investments, however, are usually smaller, ranging from a few hundred thousand to a few million dollars, depending on the stage of the company.

3. Level of Involvement

Private equity firms often take a hands-on approach, actively participating in the management and operations of the companies they invest in. They may implement strategic changes, improve efficiencies, or even replace management. Venture capital firms, while also involved, tend to take a more advisory role, providing guidance and mentorship to help startups grow.

4. Risk and Return Profile

Private equity investments are considered lower risk compared to venture capital because they involve established companies with proven business models. However, the returns can still be substantial. Venture capital investments are higher risk due to the uncertainty of startup success, but they offer the potential for exponential returns if the company becomes a market leader.

See Also As a New Business What Are the Odds of Getting Venture Capital Funding

As a New Business What Are the Odds of Getting Venture Capital Funding5. Exit Strategies

Private equity firms typically aim for longer-term investments, often holding onto companies for 5 to 10 years before exiting through a sale or IPO. Venture capital firms, on the other hand, may seek shorter-term exits, often within 3 to 7 years, through acquisitions or IPOs, depending on the startup's growth trajectory.

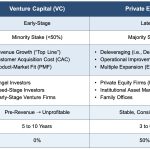

| Aspect | Private Equity | Venture Capital |

|---|---|---|

| Investment Stage | Established companies | Early-stage startups |

| Size of Investment | Large (hundreds of millions to billions) | Small (thousands to millions) |

| Level of Involvement | Hands-on management | Advisory role |

| Risk and Return | Lower risk, substantial returns | Higher risk, potential for exponential returns |

| Exit Strategy | Long-term (5-10 years) | Short-term (3-7 years) |

Understanding the Core Differences Between Private Equity and Venture Capital Firms

1. Investment Stage: Early-Stage vs. Mature Companies

Private equity firms and venture capital firms differ significantly in the investment stages they target. Venture capital firms typically focus on early-stage companies or startups that are in the initial phases of development. These companies often have high growth potential but may not yet be profitable. In contrast, private equity firms usually invest in mature companies that are already established and generating steady revenue. These firms often seek to acquire a controlling stake in the company, allowing them to implement strategic changes to improve profitability.

2. Risk Appetite: High Risk vs. Lower Risk

The risk appetite of private equity and venture capital firms also varies. Venture capital is inherently high-risk because it involves investing in unproven businesses with uncertain futures. Many startups fail, but the potential for exponential returns on successful investments makes this risk acceptable for venture capitalists. On the other hand, private equity firms tend to take on lower-risk investments by targeting established companies with proven business models. While the returns may not be as high as those from venture capital, they are generally more predictable and stable.

See Also What Are the Key Differences Between Private Equity and Venture Capital

What Are the Key Differences Between Private Equity and Venture Capital3. Investment Size: Smaller vs. Larger Deals

The size of investments is another key difference. Venture capital firms typically make smaller investments compared to private equity firms. These investments are often in the range of a few million dollars, as startups usually require less capital to get off the ground. In contrast, private equity firms often engage in larger deals, sometimes involving billions of dollars, as they acquire or invest in established companies that require significant capital to restructure or expand.

4. Involvement in Operations: Hands-On vs. Strategic Oversight

The level of involvement in operations also distinguishes the two types of firms. Venture capital firms often take a hands-on approach, providing mentorship, strategic guidance, and networking opportunities to help startups grow. They may also take a seat on the company’s board to influence decision-making. Conversely, private equity firms focus more on strategic oversight. They may replace management teams, streamline operations, or implement cost-cutting measures to enhance the company’s value before eventually selling it for a profit.

5. Exit Strategies: IPOs vs. Buyouts

The exit strategies employed by private equity and venture capital firms differ as well. Venture capital firms often aim for an initial public offering (IPO) as their exit strategy, allowing them to sell their shares in the company once it goes public. This can result in significant returns if the company’s valuation increases. On the other hand, private equity firms typically exit through buyouts or sales to other investors. They may also take the company public, but their primary goal is to sell their stake at a higher valuation after improving the company’s performance.

By understanding these differences, investors and entrepreneurs can better navigate the financial landscape and choose the right type of firm to meet their needs.

Frequently Asked Questions from Our Community

What is the main difference between private equity and venture capital firms?

Private equity firms and venture capital firms differ primarily in the types of companies they invest in and their investment strategies. Private equity firms typically invest in established companies that are already generating revenue or profit, often acquiring a controlling stake. These firms focus on restructuring, improving operations, and driving growth to increase the company's value. On the other hand, venture capital firms invest in early-stage startups or companies with high growth potential, often taking minority stakes. Their goal is to support innovation and help these companies scale rapidly.

How do private equity and venture capital firms differ in terms of risk?

Private equity firms generally take on lower risk compared to venture capital firms because they invest in mature, stable companies with proven business models. These investments are often secured with tangible assets, reducing the likelihood of total loss. In contrast, venture capital firms face higher risk as they invest in unproven startups with uncertain futures. Many of these startups may fail, but the potential for outsized returns from successful investments drives venture capitalists to take on this risk.

What is the typical investment size for private equity versus venture capital?

Private equity firms usually make larger investments, often ranging from tens of millions to billions of dollars, as they target established companies requiring significant capital for acquisitions or expansions. In contrast, venture capital firms typically invest smaller amounts, often between a few hundred thousand to several million dollars, in early-stage companies. These smaller investments align with the higher risk and the need to diversify across multiple startups to maximize the chances of success.

How do private equity and venture capital firms differ in their involvement with portfolio companies?

Private equity firms often take a hands-on approach with their portfolio companies, actively participating in management decisions, restructuring, and operational improvements. They may replace executives or implement new strategies to enhance profitability. Conversely, venture capital firms tend to take a more advisory role, providing mentorship, industry connections, and strategic guidance to help startups grow. Their involvement is usually less intrusive, as they focus on supporting the entrepreneurial vision of the founders.

Leave a Reply

Our Recommended Articles