Securing funding from an angel investor requires more than just a compelling business plan. While your business plan outlines your vision and strategy, investors often demand additional documentation to assess the viability and credibility of your venture. These documents provide a deeper understanding of your business, its financial health, and its potential for growth. From financial statements and market analysis to legal agreements and team credentials, presenting the right paperwork can significantly influence an investor’s decision. This article explores the essential documents you need to prepare beyond your business plan to build trust, demonstrate professionalism, and increase your chances of securing angel investment.

- What Are the Documents I Need to Present to a Potential Angel Investor to Get Funded Besides My Business Plan?

- What to present to angel investors?

- What paperwork is needed for investors?

- What are the documents used by fund managers to invite investors?

- How do you ask an angel investor for money?

- Frequently Asked Questions from Our Community

What Are the Documents I Need to Present to a Potential Angel Investor to Get Funded Besides My Business Plan?

When approaching a potential angel investor, your business plan is just the starting point. To build trust and demonstrate professionalism, you need to provide additional documents that showcase your business's viability, financial health, and growth potential. Below are the key documents you should prepare:

1. Executive Summary

The executive summary is a concise overview of your business, highlighting the most critical aspects such as your mission, product or service, target market, and financial projections. It should be compelling enough to grab the investor's attention and encourage them to dive deeper into your proposal.

See Also How Do You Write a Good Venture Capital Proposal?

How Do You Write a Good Venture Capital Proposal?2. Financial Statements

Investors want to see your financial health. Prepare income statements, balance sheets, and cash flow statements for at least the past three years (if applicable). If you're a startup, include projected financial statements for the next 3-5 years. These documents help investors assess your profitability and sustainability.

3. Cap Table

A cap table (capitalization table) outlines the ownership structure of your company. It shows who owns what percentage of the business, including founders, employees, and existing investors. This document is crucial for investors to understand how their investment will impact the company's equity.

4. Pitch Deck

A pitch deck is a visual presentation that complements your business plan. It should include slides on your business model, market opportunity, competitive advantage, team, and financial projections. Keep it concise and visually appealing to make a strong impression.

See Also Venture Capital: Which Vcs Blog?

Venture Capital: Which Vcs Blog?5. Legal Documents

Investors will want to review your legal documents to ensure there are no hidden risks. These may include articles of incorporation, bylaws, intellectual property agreements, and any existing contracts or partnership agreements. Having these ready shows that your business is legally sound.

| Document | Purpose |

|---|---|

| Executive Summary | Provides a quick overview of your business. |

| Financial Statements | Shows your financial health and projections. |

| Cap Table | Details ownership structure and equity distribution. |

| Pitch Deck | Visually presents your business plan and key metrics. |

| Legal Documents | Ensures legal compliance and reduces investor risk. |

What to present to angel investors?

1. A Clear and Compelling Business Idea

When presenting to angel investors, the first thing you need is a clear and compelling business idea. This should outline the problem your product or service solves and why it is unique. Investors want to see that your idea has the potential to disrupt the market or fill a significant gap. Ensure your pitch is concise and easy to understand.

See Also What Are the Best Venture Capital Newsletters?

What Are the Best Venture Capital Newsletters?- Define the problem your business addresses.

- Explain your solution and how it stands out from competitors.

- Highlight the market need and potential demand.

2. A Strong Business Plan

A strong business plan is essential to demonstrate that you have a roadmap for success. This should include your business model, revenue streams, and growth strategy. Investors want to see that you have a clear plan for scaling the business and achieving profitability.

- Outline your business model and revenue streams.

- Detail your growth strategy and milestones.

- Include financial projections and break-even analysis.

3. Market Research and Validation

Angel investors want to see that you have conducted thorough market research and have validation for your idea. This includes data on your target audience, market size, and competitive landscape. Providing evidence of customer interest or early sales can significantly strengthen your pitch.

- Present data on your target market and its size.

- Showcase competitive analysis and your unique value proposition.

- Provide proof of concept through customer feedback or early sales.

4. A Strong Team

Investors often bet on the team as much as the idea. Highlight the expertise and experience of your team members, emphasizing their roles and how they contribute to the success of the business. A strong team with a track record of success can instill confidence in potential investors.

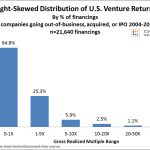

See Also What Percent of Venture Capital Funds Fail?

What Percent of Venture Capital Funds Fail?- Introduce your team members and their relevant experience.

- Explain their roles and contributions to the business.

- Highlight any past successes or industry recognition.

5. Financial Needs and Use of Funds

Clearly articulate your financial needs and how you plan to use the funds. Investors want to know exactly where their money will go and how it will help grow the business. Be specific about the amount you are seeking and the milestones you aim to achieve with the investment.

- State the amount of funding you are seeking.

- Detail how the funds will be allocated (e.g., product development, marketing, hiring).

- Explain the expected outcomes and milestones tied to the investment.

What paperwork is needed for investors?

1. Business Plan and Financial Projections

Investors typically require a comprehensive business plan and financial projections to evaluate the potential of your business. These documents should include:

See Also Which Venture Capital Firms Invest in Online Marketplaces?

Which Venture Capital Firms Invest in Online Marketplaces?- Executive Summary: A brief overview of your business, its mission, and its goals.

- Market Analysis: Detailed research on your target market, competition, and industry trends.

- Financial Projections: Forecasts of revenue, expenses, and profitability over the next 3-5 years.

2. Legal Documents

Investors will need to review various legal documents to ensure your business is compliant and properly structured. Key documents include:

- Articles of Incorporation: Proof that your business is legally registered.

- Operating Agreement or Bylaws: Outlines the management structure and operating procedures.

- Intellectual Property Documentation: Patents, trademarks, or copyrights that protect your business assets.

3. Financial Statements

Accurate and up-to-date financial statements are crucial for investors to assess your business's financial health. These typically include:

- Balance Sheet: Shows your assets, liabilities, and equity at a specific point in time.

- Income Statement: Details your revenue, expenses, and profits over a period.

- Cash Flow Statement: Tracks the flow of cash in and out of your business.

4. Cap Table and Equity Information

Investors will want to see a capitalization table (cap table) and details about equity distribution. This includes:

- Current Ownership Structure: Who owns what percentage of the company.

- Previous Funding Rounds: Details of any prior investments and the terms.

- Stock Options and Warrants: Information on any outstanding options or warrants that could affect equity.

5. Investor Agreements and Term Sheets

Before finalizing an investment, investors will require term sheets and investor agreements. These documents outline the terms of the investment and include:

- Investment Amount: The total amount of money being invested.

- Valuation: The pre-money and post-money valuation of your company.

- Rights and Obligations: Any special rights or obligations granted to the investor, such as board seats or veto rights.

What are the documents used by fund managers to invite investors?

Private Placement Memorandum (PPM)

A Private Placement Memorandum (PPM) is a legal document provided to potential investors by fund managers. It outlines the terms, risks, and objectives of the investment opportunity. The PPM is crucial for ensuring transparency and compliance with securities regulations. Key components of a PPM include:

- Investment Strategy: Details the fund's approach to achieving returns.

- Risk Factors: Highlights potential risks associated with the investment.

- Fee Structure: Explains management fees, performance fees, and other costs.

Offering Memorandum (OM)

An Offering Memorandum (OM) is similar to a PPM but is often used in international markets. It provides comprehensive information about the fund, including its structure, management team, and financial projections. The OM is designed to help investors make informed decisions. Key elements include:

- Fund Structure: Describes the legal and operational framework of the fund.

- Management Team: Introduces the fund managers and their experience.

- Financial Projections: Offers insights into expected returns and growth potential.

Term Sheet

A Term Sheet is a concise document that outlines the key terms and conditions of the investment. It serves as a preliminary agreement between the fund manager and the investor. The term sheet is non-binding but sets the stage for further negotiations. Important aspects include:

- Investment Amount: Specifies the minimum and maximum investment amounts.

- Valuation: Provides the pre-money and post-money valuation of the fund.

- Liquidity Terms: Details the exit options available to investors.

Subscription Agreement

The Subscription Agreement is a formal contract between the investor and the fund. It legally binds the investor to the terms outlined in the PPM or OM. This document is essential for finalizing the investment. Key components include:

- Investor Information: Collects personal and financial details of the investor.

- Representations and Warranties: Ensures the investor meets eligibility criteria.

- Signature and Date: Formalizes the agreement with the investor's consent.

Due Diligence Questionnaire (DDQ)

A Due Diligence Questionnaire (DDQ) is used by fund managers to gather detailed information from potential investors. It helps in assessing the suitability of the investor for the fund. The DDQ covers various aspects of the investor's background and investment goals. Key sections include:

- Investment Objectives: Aligns the investor's goals with the fund's strategy.

- Financial History: Reviews the investor's past investment performance.

- Regulatory Compliance: Ensures the investor meets legal and regulatory requirements.

How do you ask an angel investor for money?

How to Prepare Before Approaching an Angel Investor

Before asking an angel investor for money, it is crucial to prepare thoroughly. This ensures you present a compelling case and demonstrate professionalism. Here are the key steps:

- Research the investor: Understand their investment focus, past deals, and industries they prefer.

- Refine your pitch: Create a concise and engaging pitch deck that highlights your business model, market opportunity, and growth potential.

- Know your numbers: Be ready to discuss financial projections, revenue streams, and funding requirements in detail.

- Prepare a business plan: Include a clear roadmap, competitive analysis, and long-term vision.

- Practice your delivery: Rehearse your pitch to ensure clarity, confidence, and the ability to answer tough questions.

How to Craft a Compelling Pitch

A compelling pitch is essential to capture an angel investor's interest. Focus on clarity, storytelling, and demonstrating value. Here’s how to do it:

- Start with a strong hook: Grab their attention by explaining the problem your business solves.

- Showcase your solution: Highlight your product or service and its unique value proposition.

- Demonstrate market potential: Provide data on market size, target audience, and growth opportunities.

- Highlight traction: Share milestones, customer feedback, or early sales to prove demand.

- End with a clear ask: Specify the amount you need and how the funds will be used.

How to Build a Relationship with an Angel Investor

Building a relationship with an angel investor goes beyond the initial pitch. It requires trust, transparency, and consistent communication. Follow these steps:

- Network strategically: Attend industry events, join startup communities, and leverage mutual connections.

- Be transparent: Share both successes and challenges to build credibility.

- Provide updates: Regularly update them on your progress, even if they haven’t invested yet.

- Seek advice: Ask for their input on your business to show you value their expertise.

- Be patient: Building trust takes time, so avoid rushing the process.

How to Negotiate Terms with an Angel Investor

Negotiating terms with an angel investor requires a balance between securing funding and protecting your business. Here’s how to approach it:

- Understand valuation: Determine a fair valuation for your company based on market standards and growth potential.

- Clarify equity stakes: Be clear about how much equity you’re willing to offer in exchange for funding.

- Discuss control: Address any concerns about decision-making power and investor involvement.

- Review legal documents: Work with a lawyer to ensure terms are fair and legally sound.

- Be flexible: Be open to compromise while protecting your core interests.

How to Follow Up After the Initial Meeting

Following up effectively after the initial meeting can keep the conversation alive and increase your chances of securing funding. Here’s what to do:

- Send a thank-you note: Express gratitude for their time and reiterate key points from your pitch.

- Provide additional information: Share any requested documents or data promptly.

- Schedule a follow-up meeting: Propose a timeline for the next discussion to maintain momentum.

- Address concerns: Respond to any objections or questions they raised during the meeting.

- Stay engaged: Keep them updated on your progress and milestones to reinforce your credibility.

Frequently Asked Questions from Our Community

What financial documents should I prepare for an angel investor?

When presenting to a potential angel investor, it's crucial to provide detailed financial documents that demonstrate the viability and growth potential of your business. These typically include profit and loss statements, cash flow statements, and balance sheets. Additionally, prepare a financial forecast that outlines your projected revenue, expenses, and profitability over the next 3-5 years. These documents help investors assess the financial health of your business and its ability to generate returns.

Do I need to provide a cap table for my startup?

Yes, a cap table (capitalization table) is essential when approaching an angel investor. This document outlines the ownership structure of your company, including the percentage of equity held by founders, employees, and existing investors. It also details any outstanding shares, options, or warrants. A clear and accurate cap table helps investors understand their potential ownership stake and the dilution of equity in future funding rounds.

Should I include a pitch deck alongside my business plan?

Absolutely. A pitch deck is a concise and visually appealing presentation that complements your business plan. It should highlight key aspects of your business, such as the problem you're solving, your solution, market opportunity, business model, and team. While the business plan provides in-depth details, the pitch deck serves as a quick overview to capture the investor's interest and encourage further discussion.

Is a term sheet necessary before meeting with an angel investor?

While a term sheet is not mandatory for initial meetings, it can be beneficial to have a draft ready. A term sheet outlines the key terms and conditions of the proposed investment, such as valuation, investment amount, equity stake, and rights of the investor. Presenting a term sheet early in the process shows that you are prepared and serious about the investment, which can help streamline negotiations and build trust with the investor.

Leave a Reply

Our Recommended Articles