Venture capital (VC) firms are known for their dynamic and fast-paced environments, where professionals navigate a structured hierarchy to drive investment decisions and support portfolio companies. The career progression within a VC firm typically follows a well-defined path, starting from entry-level roles such as analysts or associates, advancing to mid-level positions like senior associates or principals, and culminating in leadership roles such as partners or managing partners. Each level requires a unique blend of skills, experience, and network-building. This article explores the hierarchy within a venture capital firm, the responsibilities at each stage, and the average time it takes to progress through the ranks.

- What is the Hierarchy Like at a Venture Capital Firm and How Long Does It Take to Reach Each Level?

- 1. Entry-Level Positions: Analyst and Associate Roles

- 2. Mid-Level Positions: Senior Associate and Principal Roles

- 3. Senior-Level Positions: Vice President (VP) and Partner Roles

- 4. Top-Level Positions: General Partner and Managing Partner Roles

- 5. Factors Influencing Career Progression in Venture Capital

- What is the hierarchy in a venture capital firm?

- What are the stages of the venture capital process?

- What is the structure of venture capital?

- What is the highest position in venture capital?

- Frequently Asked Questions from Our Community

- What are the typical levels in the hierarchy of a venture capital firm?

- How long does it take to move from an Analyst to a Partner role in venture capital?

- What skills are essential to advance in a venture capital firm's hierarchy?

- What challenges might one face when climbing the hierarchy in venture capital?

What is the Hierarchy Like at a Venture Capital Firm and How Long Does It Take to Reach Each Level?

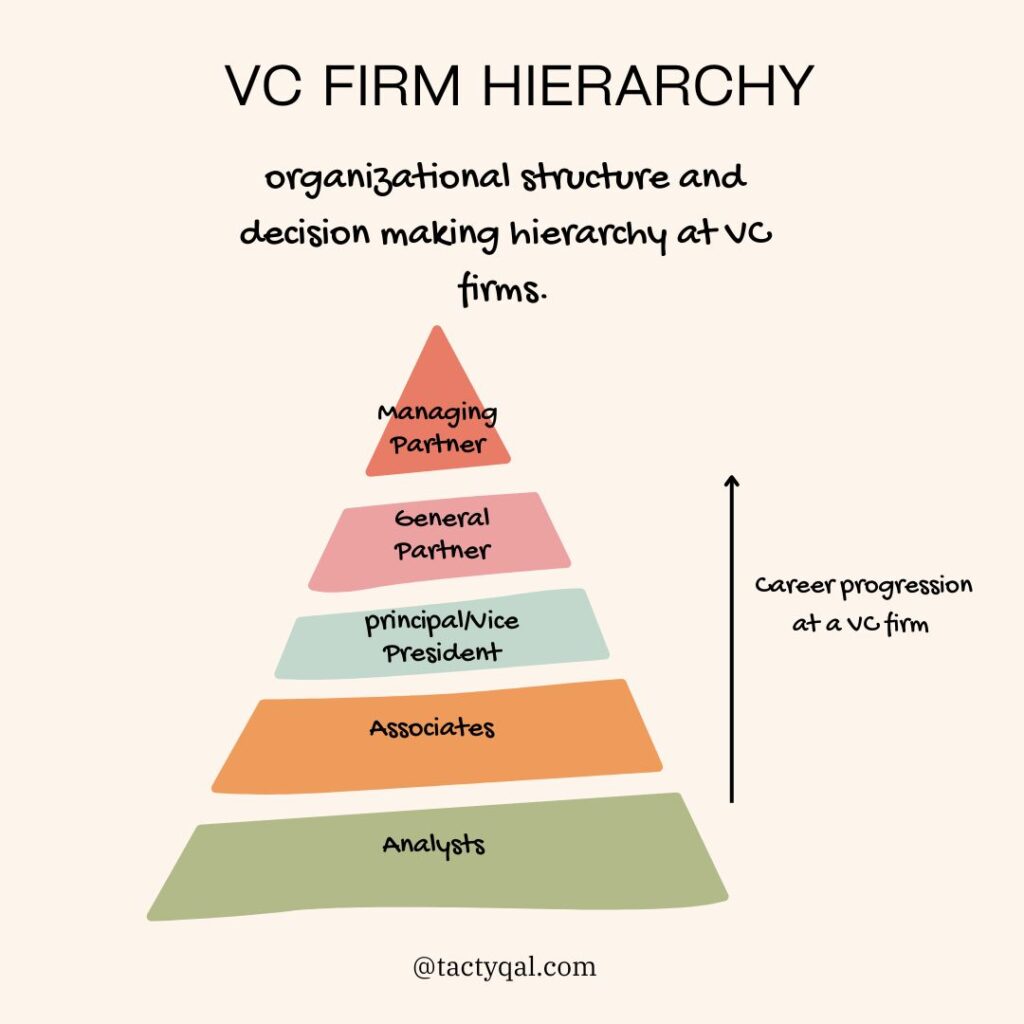

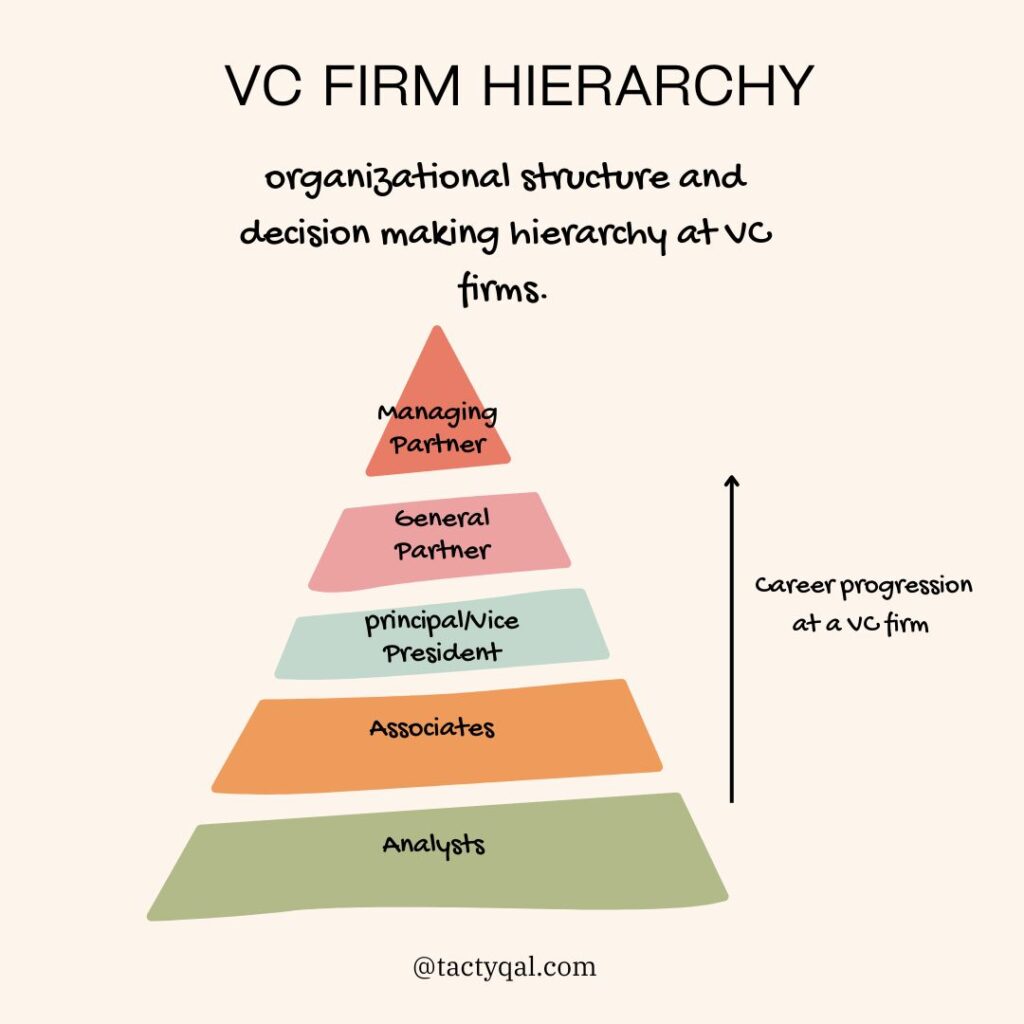

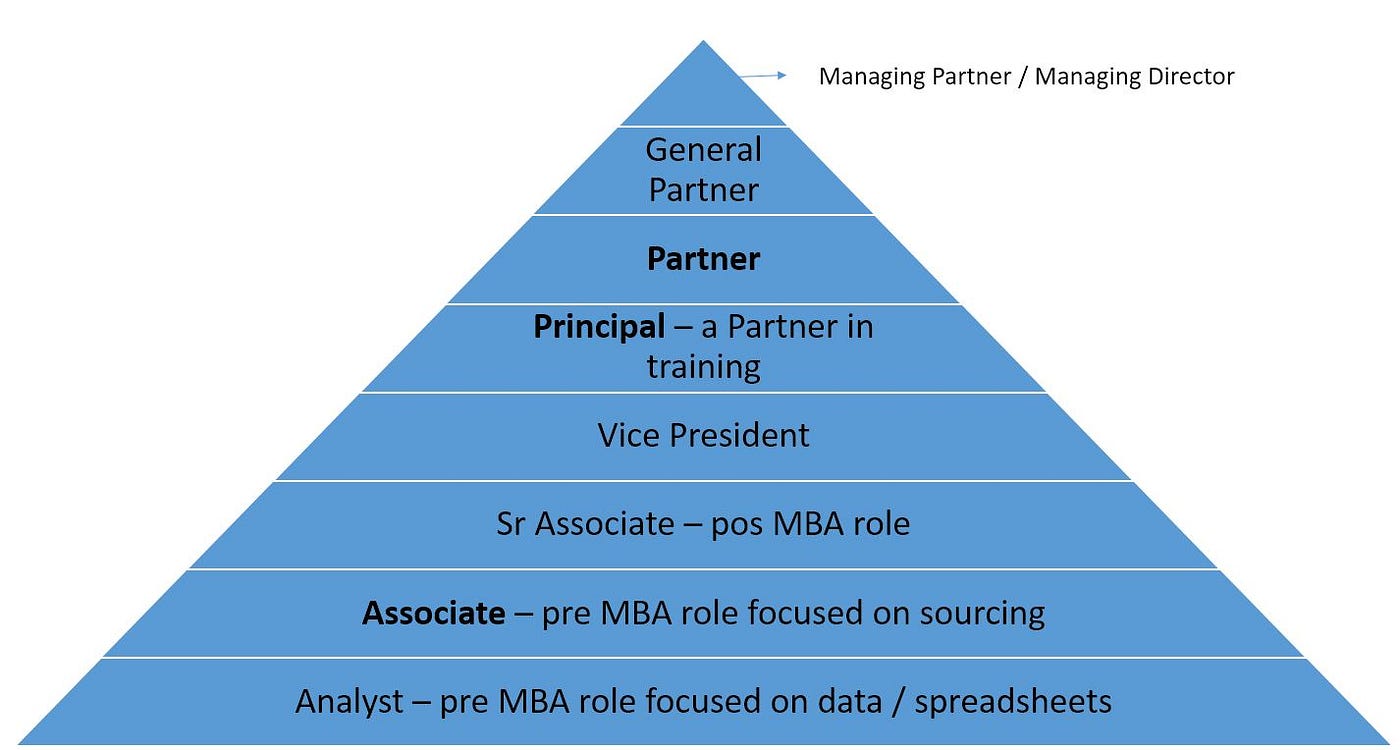

Venture capital (VC) firms have a structured hierarchy that defines roles, responsibilities, and career progression. The journey from entry-level positions to senior roles typically involves gaining experience, building a network, and demonstrating expertise in evaluating startups and managing investments. Below, we break down the hierarchy and the time it generally takes to advance through each level.

1. Entry-Level Positions: Analyst and Associate Roles

At the base of the hierarchy are Analysts and Associates. These roles are typically entry-level and involve tasks such as market research, due diligence, and supporting senior team members. Analysts often come straight from undergraduate programs, while Associates may have an MBA or a few years of work experience. It usually takes 2-3 years to move from an Analyst to an Associate role.

See Also Is Goldman Sachs or Venture Capital a Better Career Starter?

Is Goldman Sachs or Venture Capital a Better Career Starter?| Role | Responsibilities | Time to Advance |

|---|---|---|

| Analyst | Market research, data analysis, supporting deals | 2-3 years |

| Associate | Deal sourcing, due diligence, portfolio management | 2-3 years |

2. Mid-Level Positions: Senior Associate and Principal Roles

The next step up is the Senior Associate or Principal level. These professionals take on more responsibility, including leading deals, managing relationships with founders, and mentoring junior team members. Reaching this level usually requires 3-5 years of experience as an Associate, along with a proven track record of successful investments.

| Role | Responsibilities | Time to Advance |

|---|---|---|

| Senior Associate | Leading deals, mentoring juniors, portfolio oversight | 3-5 years |

| Principal | Deal execution, strategic decision-making, LP relations | 3-5 years |

3. Senior-Level Positions: Vice President (VP) and Partner Roles

At the senior level, Vice Presidents (VPs) and Partners play a critical role in shaping the firm's strategy and making high-stakes investment decisions. VPs often have 5-7 years of experience, while Partners are typically seasoned professionals with 10+ years in the industry. Partners also focus on fundraising and maintaining relationships with limited partners (LPs).

| Role | Responsibilities | Time to Advance |

|---|---|---|

| Vice President (VP) | Strategic investments, team leadership, LP engagement | 5-7 years |

| Partner | Fundraising, high-level decision-making, firm leadership | 10+ years |

4. Top-Level Positions: General Partner and Managing Partner Roles

The pinnacle of the hierarchy is the General Partner (GP) or Managing Partner role. These individuals are the face of the firm, responsible for overall strategy, fundraising, and ensuring the firm's success. Reaching this level often requires 15+ years of experience and a strong reputation in the industry.

See Also Is Venture Capital or Real Estate Development More Lucrative

Is Venture Capital or Real Estate Development More Lucrative| Role | Responsibilities | Time to Advance |

|---|---|---|

| General Partner (GP) | Firm strategy, fundraising, high-level investments | 15+ years |

| Managing Partner | Overall firm leadership, key decision-making | 15+ years |

5. Factors Influencing Career Progression in Venture Capital

Career progression in VC depends on several factors, including performance, networking, deal success, and industry reputation. Additionally, the size and structure of the firm can impact how quickly one advances. Smaller firms may offer faster progression, while larger firms often have more defined hierarchies and longer timelines.

| Factor | Impact on Progression |

|---|---|

| Performance | High performance accelerates promotions |

| Networking | Strong networks open doors to opportunities |

| Deal Success | Successful investments build credibility |

| Industry Reputation | A strong reputation attracts top roles |

What is the hierarchy in a venture capital firm?

1. General Partners (GPs)

General Partners (GPs) are the senior-most members of a venture capital firm and hold the most responsibility. They are typically involved in making investment decisions, managing portfolio companies, and raising funds from limited partners. Their roles include:

See Also Which Venture Capital Firms Have Major Offices in Chicago?

Which Venture Capital Firms Have Major Offices in Chicago?- Investment Decisions: GPs evaluate and decide which startups or companies to invest in.

- Fund Management: They oversee the fund's operations and ensure compliance with legal and financial regulations.

- Portfolio Oversight: GPs actively monitor and support the growth of portfolio companies.

2. Venture Partners

Venture Partners are experienced professionals who work closely with GPs but are not full-time employees. They often bring industry expertise and networks to the firm. Their responsibilities include:

- Deal Sourcing: They identify and bring potential investment opportunities to the firm.

- Mentorship: Venture Partners provide guidance to portfolio companies and founders.

- Advisory Role: They assist in due diligence and strategic decision-making.

3. Principals

Principals are mid-level professionals who play a key role in deal execution and portfolio management. They are often on track to become GPs. Their duties include:

- Deal Execution: Principals lead the due diligence process and negotiate terms with startups.

- Analysis: They conduct market research and financial modeling to assess investment opportunities.

- Portfolio Support: Principals work closely with portfolio companies to help them scale.

4. Associates

Associates are entry-level or junior professionals who support the investment team. They are responsible for research and administrative tasks. Their roles include:

See Also How Do Associates at Venture Capital Firms Source Deals?

How Do Associates at Venture Capital Firms Source Deals?- Research: Associates gather data on industries, markets, and potential investments.

- Deal Flow: They help screen and evaluate incoming investment opportunities.

- Presentation: Associates prepare reports and presentations for senior team members.

5. Analysts

Analysts are typically recent graduates or early-career professionals who assist in data analysis and administrative tasks. Their responsibilities include:

- Data Analysis: Analysts compile and analyze financial and market data.

- Support: They assist Associates and Principals in their day-to-day tasks.

- Reporting: Analysts help create investment memos and performance reports.

What are the stages of the venture capital process?

1. Deal Sourcing and Initial Screening

The first stage of the venture capital process involves deal sourcing, where venture capitalists identify potential investment opportunities. This can be done through various channels such as networking events, referrals, or direct outreach. Once a potential deal is identified, an initial screening is conducted to assess whether the opportunity aligns with the venture capital firm's investment criteria. Key factors considered during this stage include the startup's market potential, team expertise, and product innovation.

See Also What Are the Best Performing Venture Capital Funds of All Time

What Are the Best Performing Venture Capital Funds of All Time- Identify potential investment opportunities through networking or referrals.

- Evaluate the startup's alignment with the firm's investment focus.

- Conduct a preliminary review of the business model and market potential.

2. Due Diligence and Evaluation

During the due diligence phase, venture capitalists conduct a thorough analysis of the startup's business model, financials, market position, and team. This stage is critical to identify any potential risks or red flags. The evaluation process often includes reviewing financial statements, conducting market research, and interviewing key stakeholders. The goal is to ensure that the investment is sound and that the startup has the potential to deliver high returns.

- Analyze the startup's financial health and projections.

- Assess the competitive landscape and market opportunity.

- Interview founders and key team members to evaluate their capabilities.

3. Term Sheet Negotiation

Once due diligence is completed and the venture capitalist decides to move forward, a term sheet is presented to the startup. This document outlines the key terms and conditions of the investment, including valuation, equity stake, and governance rights. Negotiations may take place to ensure both parties agree on the terms. The term sheet serves as the foundation for the final legal agreements and is a critical step in formalizing the investment.

- Present a term sheet outlining investment terms.

- Negotiate key terms such as valuation and equity distribution.

- Finalize the agreement to proceed with the investment.

4. Investment and Funding

After the term sheet is agreed upon, the venture capitalist provides the funding to the startup. This stage involves the transfer of capital in exchange for equity or other agreed-upon terms. The funds are typically used to fuel the startup's growth, whether through product development, market expansion, or hiring key talent. The venture capitalist may also take an active role in guiding the startup's strategy and operations.

- Transfer capital to the startup in exchange for equity.

- Allocate funds for growth initiatives such as product development or hiring.

- Engage in strategic guidance and mentorship.

5. Post-Investment Monitoring and Exit Strategy

The final stage involves monitoring the startup's progress and preparing for an eventual exit. Venture capitalists actively track the startup's performance, providing support and resources as needed. The goal is to maximize the investment's value over time. Exit strategies may include an initial public offering (IPO), acquisition, or secondary market sale. The timing and method of exit are carefully planned to ensure optimal returns.

- Monitor the startup's performance and milestones.

- Provide ongoing support and resources to drive growth.

- Plan and execute an exit strategy to realize returns.

What is the structure of venture capital?

What is the Structure of Venture Capital?

The structure of venture capital involves a systematic framework that connects investors, entrepreneurs, and intermediaries to fund and grow startups. It typically includes the following components:

- Limited Partners (LPs): These are the investors who provide the capital, such as pension funds, endowments, or wealthy individuals.

- General Partners (GPs): These are the venture capital firms or fund managers who make investment decisions and manage the fund.

- Portfolio Companies: Startups or high-growth companies that receive funding in exchange for equity.

- Fund Lifecycle: Venture capital funds have a fixed lifespan, usually 10 years, divided into investment and harvest periods.

- Exit Strategies: Methods like IPOs, acquisitions, or mergers to provide returns to investors.

How Do Venture Capital Funds Operate?

Venture capital funds operate through a structured process that ensures efficient allocation of resources and maximizes returns. Key steps include:

- Fundraising: GPs raise capital from LPs to create a fund.

- Deal Sourcing: Identifying and evaluating potential investment opportunities.

- Due Diligence: Conducting thorough research on the startup’s business model, team, and market potential.

- Investment: Providing capital in exchange for equity stakes.

- Value Addition: Offering mentorship, strategic guidance, and networking opportunities to portfolio companies.

What Are the Roles of Limited Partners and General Partners?

In the venture capital structure, Limited Partners (LPs) and General Partners (GPs) have distinct roles:

- LPs: Provide the majority of the capital but have limited involvement in day-to-day operations.

- GPs: Manage the fund, make investment decisions, and oversee portfolio companies.

- Profit Sharing: GPs typically earn management fees (1-2% of the fund) and a carried interest (20% of profits).

- Risk Allocation: LPs bear the financial risk, while GPs take on operational and reputational risks.

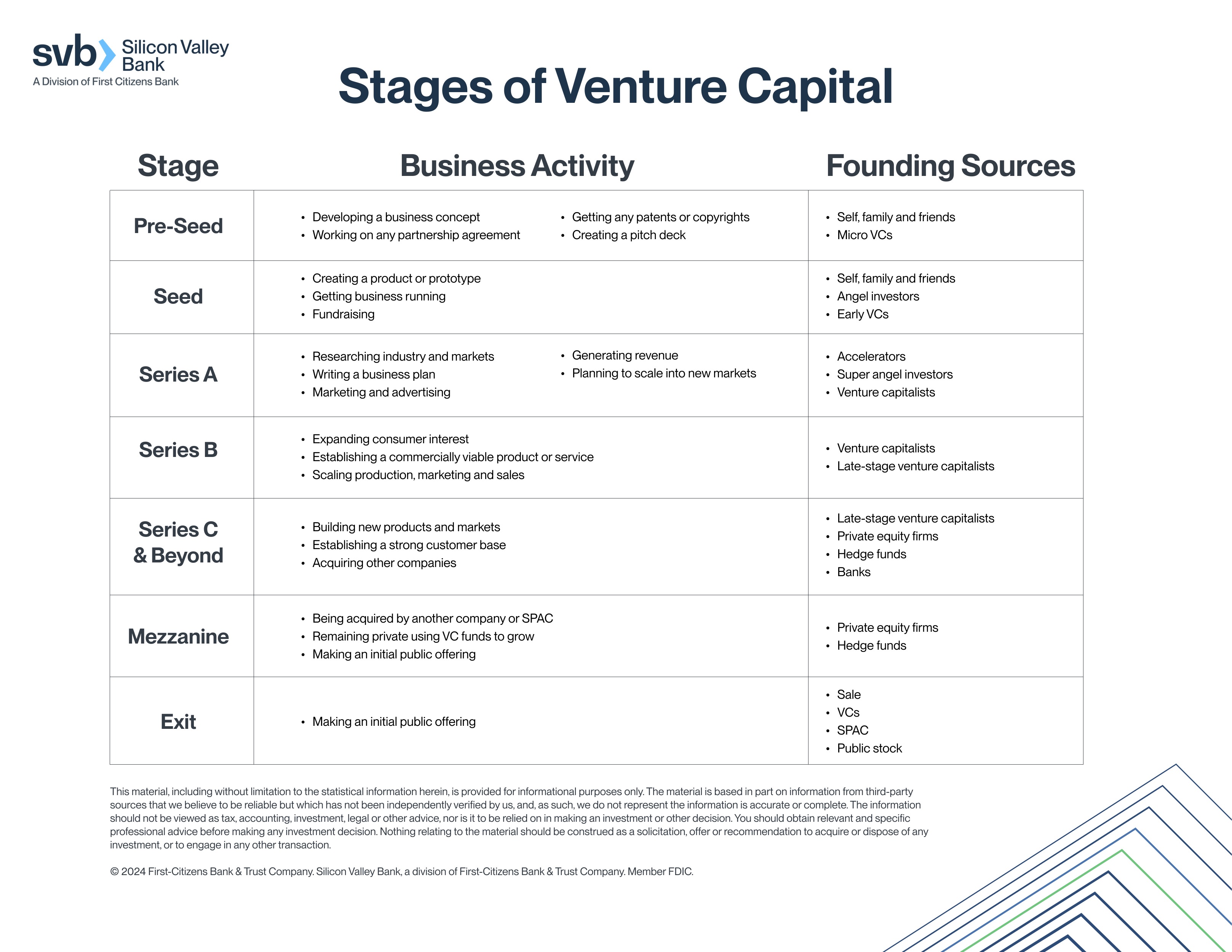

What Are the Stages of Venture Capital Investment?

Venture capital investments are made in various stages, depending on the startup’s growth phase:

- Seed Stage: Early funding to develop a product or idea.

- Early Stage: Funding for product development, market entry, and initial scaling.

- Growth Stage: Capital for scaling operations, expanding markets, and increasing revenue.

- Late Stage: Investments to prepare for an IPO or acquisition.

What Are the Key Components of a Venture Capital Fund?

A venture capital fund consists of several critical components that ensure its success:

- Fund Size: The total amount of capital raised from LPs.

- Investment Thesis: The strategy guiding which startups to invest in.

- Management Fees: Annual fees charged by GPs to cover operational costs.

- Carried Interest: The share of profits GPs receive after returning the initial capital to LPs.

- Term Sheet: A document outlining the terms and conditions of the investment.

What is the highest position in venture capital?

The highest position in venture capital is typically the Managing Partner or General Partner (GP). This individual holds the most senior role within a venture capital firm and is responsible for overseeing the firm's operations, making investment decisions, and managing relationships with investors (limited partners) and portfolio companies. The Managing Partner often has significant influence over the firm's strategy, fund allocation, and overall direction.

What Does a Managing Partner Do in Venture Capital?

The Managing Partner in a venture capital firm plays a critical role in shaping the firm's success. Their responsibilities include:

- Investment Decisions: They lead the process of identifying, evaluating, and approving potential investments in startups or high-growth companies.

- Fund Management: They oversee the allocation of capital from the fund, ensuring it aligns with the firm's investment thesis and goals.

- Investor Relations: They maintain strong relationships with limited partners (LPs), providing updates on fund performance and securing commitments for future funds.

How Does Someone Become a Managing Partner?

Becoming a Managing Partner in venture capital requires a combination of experience, expertise, and networking. Key steps include:

- Industry Experience: Gaining extensive experience in venture capital, private equity, or entrepreneurship is essential.

- Track Record: Demonstrating a history of successful investments and exits is critical to earning credibility.

- Networking: Building strong relationships within the venture capital ecosystem, including with founders, investors, and other partners.

What Are the Key Skills of a Managing Partner?

A successful Managing Partner possesses a unique set of skills, including:

- Strategic Thinking: The ability to identify long-term trends and opportunities in the market.

- Leadership: Strong leadership skills to guide the firm and mentor junior team members.

- Negotiation: Expertise in negotiating deal terms and managing relationships with stakeholders.

What Is the Difference Between a General Partner and a Managing Partner?

While both roles are senior positions in venture capital, there are key differences:

- Scope of Responsibility: A Managing Partner typically has broader responsibilities, including overall firm management, while a General Partner focuses more on investments.

- Decision-Making Authority: The Managing Partner often has the final say in major decisions, whereas General Partners may have more specialized roles.

- Investor Relations: Managing Partners are usually the primary point of contact for limited partners.

What Are the Challenges Faced by a Managing Partner?

The role of a Managing Partner comes with significant challenges, such as:

- High Pressure: The responsibility of managing large sums of money and delivering returns to investors can be stressful.

- Market Volatility: Navigating economic downturns or shifts in industry trends requires adaptability.

- Competition: The venture capital industry is highly competitive, making it difficult to identify and secure the best deals.

Frequently Asked Questions from Our Community

What are the typical levels in the hierarchy of a venture capital firm?

The hierarchy at a venture capital firm typically starts with entry-level positions such as Analyst or Associate. These roles involve conducting market research, analyzing potential investments, and supporting senior team members. The next level is Senior Associate or Principal, where professionals take on more responsibility in deal sourcing and due diligence. Above this, you find Venture Partners or Partners, who are deeply involved in decision-making and portfolio management. At the top of the hierarchy are General Partners or Managing Partners, who oversee the firm's strategy, fundraising, and high-level investment decisions.

How long does it take to move from an Analyst to a Partner role in venture capital?

The timeline to progress from an Analyst to a Partner role in venture capital can vary widely depending on the firm and individual performance. On average, it takes about 5 to 10 years to reach the Partner level. Starting as an Analyst, one might spend 2-3 years before being promoted to Associate. From there, it could take another 3-5 years to become a Principal or Senior Associate. Finally, reaching the Partner level often requires demonstrating exceptional deal-making skills, a strong network, and significant contributions to the firm's success.

What skills are essential to advance in a venture capital firm's hierarchy?

Advancing in a venture capital firm requires a combination of technical skills, industry knowledge, and soft skills. Key technical skills include financial modeling, market analysis, and due diligence. A deep understanding of specific industries, such as technology or healthcare, is also crucial. Equally important are networking and relationship-building skills, as venture capital relies heavily on connections with entrepreneurs and other investors. Additionally, strong decision-making and leadership abilities are essential for higher-level roles like Principal or Partner.

What challenges might one face when climbing the hierarchy in venture capital?

Climbing the hierarchy in a venture capital firm comes with several challenges. One major hurdle is the high level of competition, as there are often fewer positions available at higher levels. Another challenge is the need to consistently prove your value through successful investments and contributions to the firm's growth. Additionally, the transition from executing tasks as an Analyst or Associate to making strategic decisions as a Partner requires a significant shift in mindset and responsibilities. Building a strong personal brand and network within the industry is also critical but can be time-consuming and demanding.

Leave a Reply

Our Recommended Articles