Equity dilution is a fundamental concept for startup founders and investors to understand as a company progresses through various funding rounds, from seed to venture capital (VC) and beyond. Each round of financing typically involves issuing new shares to investors, which reduces the ownership percentage of existing shareholders. While dilution can seem concerning, it is often a necessary trade-off for securing the capital needed to fuel growth and scale operations.

This article explores how equity dilution works, its impact on founders, early investors, and employees, and the strategies stakeholders can employ to navigate this complex process while balancing ownership and growth objectives.

- How Does Equity Dilution Work When a Startup Goes Through Several Rounds of Funding From Seed to VC?

- How does equity dilution work in startups?

- How much equity is diluted in seed rounds?

- How should you split equity in a startup?

- How many rounds of funding do startups go through?

- Frequently Asked Questions from Our Community

How Does Equity Dilution Work When a Startup Goes Through Several Rounds of Funding From Seed to VC?

Equity dilution occurs when a startup issues new shares during funding rounds, reducing the ownership percentage of existing shareholders. This process is common as startups progress from seed funding to later stages like Series A, B, and beyond. Each funding round introduces new investors, who receive shares in exchange for capital, thereby diluting the equity of founders, early employees, and initial investors. Understanding how equity dilution works is crucial for stakeholders to manage their expectations and make informed decisions.

See Also How Do You Calculate the Pro Rata Entitlement for an Existing Investor in a Company as the Company Raises a New Round of Funding

How Do You Calculate the Pro Rata Entitlement for an Existing Investor in a Company as the Company Raises a New Round of FundingWhat Is Equity Dilution in Startups?

Equity dilution refers to the reduction in ownership percentage of existing shareholders when a company issues new shares. For example, if a founder owns 100% of a startup and decides to raise capital by issuing 20% equity to investors, their ownership drops to 80%. This process is repeated in subsequent funding rounds, further diluting ownership. Dilution is a trade-off for securing the capital needed to grow the business.

How Does Seed Funding Impact Equity Dilution?

Seed funding is typically the first external capital a startup raises. At this stage, founders often exchange equity for investment, leading to initial dilution. For instance, if a startup raises $500,000 in exchange for 10% equity, the founders' ownership decreases proportionally. Seed investors usually receive preferred shares, which may include additional rights like liquidation preferences.

What Happens During Series A and Beyond?

In Series A and later rounds, startups raise larger amounts of capital, often from venture capital (VC) firms. These rounds involve significant equity dilution as VCs demand substantial ownership stakes. For example, a Series A round might involve issuing 20-30% equity to investors. The dilution continues in Series B, C, and beyond, with each round bringing in more capital and further reducing existing shareholders' stakes.

See Also What is Equity Financing and What Are Its Major Sources?

What is Equity Financing and What Are Its Major Sources?How Do Stock Options and Employee Equity Affect Dilution?

Startups often allocate equity to employees through stock options or restricted stock units (RSUs). These equity grants contribute to dilution as they increase the total number of shares outstanding. For example, if a startup reserves 10% of its equity for an employee stock option pool, existing shareholders' ownership percentages decrease accordingly. However, this dilution is often necessary to attract and retain top talent.

What Are Anti-Dilution Provisions?

Anti-dilution provisions protect investors from excessive dilution in future funding rounds. These clauses adjust the conversion rate of preferred shares if the company issues new shares at a lower valuation than previous rounds. For example, if an investor holds preferred shares with anti-dilution protection and the company raises funds at a lower valuation, their shares may convert into a larger number of common shares to maintain their ownership percentage.

| Funding Round | Equity Issued | Impact on Existing Shareholders |

|---|---|---|

| Seed | 10-20% | Initial dilution for founders and early investors |

| Series A | 20-30% | Significant dilution, often involving VCs |

| Series B | 10-20% | Further dilution, with potential anti-dilution adjustments |

| Employee Equity Pool | 10-15% | Dilution to incentivize and retain employees |

How does equity dilution work in startups?

What is Equity Dilution in Startups?

Equity dilution occurs when a startup issues new shares, reducing the ownership percentage of existing shareholders. This typically happens during funding rounds, employee stock option plans (ESOPs), or when convertible notes are converted into equity. The process is essential for raising capital but can impact the control and value of existing shares.

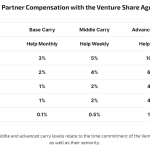

See Also How Are Advisors to a Vc Firm Compensated?

How Are Advisors to a Vc Firm Compensated?- New shares are issued to investors, employees, or other stakeholders.

- The total number of shares increases, reducing the percentage ownership of existing shareholders.

- Dilution can affect voting power and financial returns for early investors and founders.

Why Do Startups Experience Equity Dilution?

Startups often dilute equity to secure funding, attract talent, or fuel growth. Investors require ownership stakes in exchange for capital, and employees may receive stock options as part of their compensation. Dilution is a trade-off for accessing resources that help the company scale.

- Funding rounds (e.g., Seed, Series A, B, etc.) require issuing new shares to investors.

- Employee stock options are used to incentivize and retain talent.

- Convertible instruments like SAFEs or convertible notes convert into equity, leading to dilution.

How Does Equity Dilution Affect Founders?

Founders often experience significant dilution as their startup grows. While dilution reduces their ownership percentage, it can also increase the overall value of their shares if the company succeeds. However, excessive dilution may lead to loss of control over decision-making.

- Ownership percentage decreases with each funding round.

- Voting rights may diminish, especially if investors demand board seats.

- Financial upside depends on the company's valuation and growth trajectory.

What Are the Types of Equity Dilution?

Equity dilution can be categorized into two main types: economic dilution and control dilution. Economic dilution affects the financial value of shares, while control dilution impacts decision-making power.

See Also If Techstars takes a 6% equity stake for $18,000, is it fair to say a Techstars quality idea/prototype is worth $300,000 when raising seed money?

If Techstars takes a 6% equity stake for $18,000, is it fair to say a Techstars quality idea/prototype is worth $300,000 when raising seed money?- Economic dilution: Occurs when the value per share decreases due to new issuances.

- Control dilution: Happens when new shareholders gain voting rights, reducing the influence of existing shareholders.

- Anti-dilution provisions can protect investors from excessive dilution in certain scenarios.

How Can Startups Mitigate Equity Dilution?

Startups can take steps to manage and minimize equity dilution while still raising capital and rewarding stakeholders. Strategies include careful planning, negotiating favorable terms, and using alternative financing methods.

- Valuation caps on convertible notes can limit dilution for early investors.

- Equity grants to employees can be structured to minimize long-term dilution.

- Alternative funding options like revenue-based financing can reduce reliance on equity issuance.

How much equity is diluted in seed rounds?

What is Equity Dilution in Seed Rounds?

Equity dilution in seed rounds refers to the reduction in the percentage of ownership that founders and early investors experience when new shares are issued to raise capital. This process is essential for startups to secure funding but comes at the cost of reduced ownership stakes.

See Also What Does a Series 1 Financing/funding Mean?

What Does a Series 1 Financing/funding Mean?- Seed rounds typically involve issuing new shares to investors in exchange for capital.

- Founders may see their ownership percentage decrease as more shares are created.

- Early-stage investors also face dilution if they do not participate in subsequent funding rounds.

How Much Equity Do Founders Typically Give Up in Seed Rounds?

In seed rounds, founders often give up between 10% to 25% of their equity, depending on the valuation of the startup and the amount of capital raised. This percentage can vary based on the negotiation process and the perceived potential of the business.

- Startups with higher valuations may dilute less equity to raise the same amount of capital.

- Founders should carefully consider the trade-off between funding and ownership.

- Investors often seek a significant stake to justify the risk of investing in early-stage companies.

What Factors Influence Equity Dilution in Seed Rounds?

Several factors influence how much equity is diluted during seed rounds, including the startup's valuation, the amount of funding required, and the terms negotiated with investors.

- Valuation: Higher valuations result in less dilution for founders.

- Funding Amount: Larger funding rounds typically require more equity to be given up.

- Investor Terms: Some investors may demand additional rights or preferences, impacting dilution.

How Can Founders Minimize Equity Dilution in Seed Rounds?

Founders can take steps to minimize equity dilution by optimizing their startup's valuation, negotiating favorable terms, and exploring alternative funding options.

- Boost Valuation: Demonstrate strong traction, a solid business plan, and a scalable model to justify a higher valuation.

- Negotiate Terms: Work with experienced advisors to secure investor terms that protect founder equity.

- Alternative Funding: Consider options like convertible notes or SAFE agreements, which delay valuation discussions.

What Are the Long-Term Implications of Equity Dilution in Seed Rounds?

Equity dilution in seed rounds can have long-term implications for founders, including reduced control over the company and smaller financial returns in future exits.

- Control: Dilution may lead to a loss of voting power and decision-making authority.

- Financial Returns: A smaller ownership stake means less profit from a potential acquisition or IPO.

- Future Funding: Excessive dilution in early rounds can make it harder to attract investors in later stages.

How should you split equity in a startup?

Understanding the Importance of Equity Distribution

Equity distribution in a startup is crucial as it determines ownership and influences decision-making. A fair split ensures that all founders and key contributors are motivated to work towards the company's success. Here are some key points to consider:

- Alignment of Interests: Ensure that equity distribution aligns with the long-term goals and contributions of each founder.

- Future Funding: Consider how future investors will perceive the equity split and its impact on fundraising.

- Vesting Schedules: Implement vesting schedules to protect the company and ensure commitment from founders.

Factors to Consider When Splitting Equity

Several factors should be taken into account when deciding how to split equity in a startup. These factors help in creating a balanced and fair distribution:

- Initial Contributions: Assess the value of each founder's initial contributions, including capital, intellectual property, and resources.

- Roles and Responsibilities: Consider the roles and responsibilities of each founder and how they contribute to the company's growth.

- Future Contributions: Anticipate the future contributions and involvement of each founder in the startup's development.

Common Methods for Equity Splitting

There are several methods that startups can use to split equity. Each method has its own advantages and disadvantages:

- Equal Split: Dividing equity equally among all founders, which promotes fairness but may not reflect individual contributions.

- Proportional Split: Allocating equity based on the value of each founder's contributions, ensuring a more accurate reflection of input.

- Dynamic Equity Split: Adjusting equity distribution over time based on ongoing contributions and performance.

Legal and Financial Implications of Equity Splits

Equity splits have significant legal and financial implications that must be carefully managed to avoid future disputes:

- Shareholder Agreements: Draft comprehensive shareholder agreements to outline the terms and conditions of equity ownership.

- Tax Considerations: Understand the tax implications of equity distribution for both the company and the founders.

- Dispute Resolution: Establish mechanisms for resolving disputes related to equity distribution and ownership.

Best Practices for Equity Distribution

Following best practices can help ensure a smooth and fair equity distribution process:

- Transparent Communication: Maintain open and honest communication among all founders regarding equity distribution.

- Professional Advice: Seek advice from legal and financial professionals to navigate the complexities of equity splits.

- Regular Reviews: Periodically review and adjust equity distribution as the startup evolves and grows.

How many rounds of funding do startups go through?

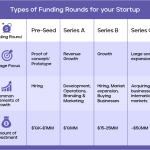

What Are the Typical Funding Rounds for Startups?

Startups typically go through several funding rounds to secure the capital needed for growth. These rounds are often categorized into stages, each serving a specific purpose in the company's development. Below is a breakdown of the most common funding rounds:

- Pre-Seed Funding: This is the earliest stage, where founders use personal savings or small investments to validate their idea.

- Seed Funding: The first official equity funding stage, used to develop a prototype or launch the product.

- Series A: Focused on scaling the business, often involving venture capital firms.

- Series B: Aimed at expanding market reach and improving infrastructure.

- Series C and Beyond: For mature companies looking to scale globally or prepare for an IPO.

Why Do Startups Need Multiple Funding Rounds?

Startups require multiple funding rounds to address different stages of their growth. Each round serves a unique purpose, ensuring the company has the resources to achieve its goals. Here’s why multiple rounds are necessary:

- Risk Mitigation: Investors prefer to fund startups in stages to minimize risk.

- Milestone-Based Funding: Funds are released as the startup achieves specific milestones.

- Scalability: Each round helps the company scale operations, enter new markets, or develop new products.

Who Participates in Startup Funding Rounds?

Different types of investors participate in startup funding rounds, depending on the stage of the company. Here’s a list of common participants:

- Angel Investors: Typically involved in pre-seed and seed rounds.

- Venture Capital Firms: Active in Series A, B, and later rounds.

- Crowdfunding Platforms: Often used during early stages to gather small investments from a large number of people.

- Corporate Investors: Participate in later rounds to align with strategic goals.

How Much Capital Is Raised in Each Funding Round?

The amount of capital raised in each funding round varies significantly based on the startup’s stage, industry, and growth potential. Below is an overview of typical amounts:

- Pre-Seed: Usually between $10,000 and $250,000.

- Seed: Ranges from $500,000 to $2 million.

- Series A: Typically between $2 million and $15 million.

- Series B: Often between $10 million and $50 million.

- Series C and Beyond: Can exceed $50 million, depending on the company’s valuation.

What Are the Key Challenges in Startup Funding Rounds?

Securing funding is a complex process, and startups often face several challenges during each round. Here are some common obstacles:

- Valuation Disputes: Disagreements between founders and investors over the company’s worth.

- Equity Dilution: Founders may lose significant ownership as more investors come on board.

- Market Competition: High competition for investor attention, especially in crowded industries.

- Regulatory Hurdles: Compliance with legal and financial regulations can delay funding.

Frequently Asked Questions from Our Community

What is equity dilution in the context of startup funding?

Equity dilution occurs when a startup issues new shares during funding rounds, reducing the ownership percentage of existing shareholders. For example, if a founder owns 100% of a company before any funding, their ownership percentage decreases as investors purchase shares in seed, Series A, Series B, and subsequent rounds. This process is essential for raising capital but comes at the cost of reduced control and ownership for early stakeholders.

How does equity dilution affect founders during multiple funding rounds?

As a startup progresses through seed funding, Series A, Series B, and beyond, founders typically experience significant equity dilution. For instance, a founder might start with 100% ownership but could see their stake reduced to 20-30% after several rounds. While this reduces their ownership percentage, the goal is to increase the company's overall valuation, making their smaller stake potentially more valuable in absolute terms.

What role do investors play in equity dilution?

Investors, such as angel investors, venture capitalists (VCs), and institutional funds, contribute capital in exchange for equity. Each funding round involves issuing new shares, which dilutes the ownership of existing shareholders, including founders and early investors. However, investors often bring not only funding but also expertise, networks, and credibility, which can help the startup grow and increase its valuation, offsetting the effects of dilution.

Can equity dilution be managed or minimized?

While equity dilution is inevitable in most funding scenarios, founders can take steps to manage it. These include negotiating favorable terms during funding rounds, setting aside an employee stock option pool (ESOP) early to avoid further dilution later, and focusing on increasing the company's valuation to ensure that even a smaller ownership percentage remains valuable. Additionally, founders can explore alternative funding methods, such as debt financing, to reduce reliance on equity-based funding.

Leave a Reply

Our Recommended Articles