In the dynamic world of venture capital, assessing the performance of portfolio companies is crucial for making informed investment decisions. Two metrics often highlighted in this context are MOIC (Multiple on Invested Capital) and IRR (Internal Rate of Return). MOIC measures the total return relative to the initial investment, providing a straightforward view of profitability. IRR, on the other hand, calculates the annualized rate of return, offering insights into the efficiency and timing of returns. While both metrics are widely used, their importance can vary depending on investment strategies and goals. This article explores whether MOIC and IRR truly stand as the most critical financial metrics for venture capital portfolios.

- Are MOIC and IRR the Most Important Financial Metrics to Track in a Venture Capital Portfolio?

- Is Moic or IRR more important?

- What are 1 or 2 important KPIs for a VC firm?

- What is a good MOIC for VC fund?

- What are the four C's of venture capital?

- Frequently Asked Questions from Our Community

- What are MOIC and IRR, and why are they important in venture capital?

- Are MOIC and IRR the only metrics that matter in a venture capital portfolio?

- How do MOIC and IRR differ in their approach to measuring investment performance?

- What are the limitations of relying solely on MOIC and IRR for portfolio analysis?

Are MOIC and IRR the Most Important Financial Metrics to Track in a Venture Capital Portfolio?

When evaluating the performance of a venture capital (VC) portfolio, investors often rely on key financial metrics to assess returns and make informed decisions. Two of the most commonly used metrics are Multiple on Invested Capital (MOIC) and Internal Rate of Return (IRR). While these metrics are widely regarded as critical indicators of success, it is essential to understand their strengths, limitations, and how they complement other performance measures. This article explores whether MOIC and IRR are indeed the most important metrics to track in a VC portfolio and provides insights into their relevance.

What is MOIC and Why is it Important?

Multiple on Invested Capital (MOIC) measures the total value returned to investors relative to the total capital invested. It is calculated by dividing the total value of distributions and remaining portfolio value by the total invested capital. For example, if a VC fund invested $10 million and returned $30 million, the MOIC would be 3x. This metric is straightforward and provides a clear picture of the absolute return on investment. However, it does not account for the time value of money, which is where IRR comes into play.

See Also I Have an Interview in Venture Capital What Are All the Things I Should Know for Modeling

I Have an Interview in Venture Capital What Are All the Things I Should Know for ModelingWhat is IRR and How Does it Differ from MOIC?

Internal Rate of Return (IRR) is a metric that calculates the annualized rate of return, taking into account the timing of cash flows. Unlike MOIC, IRR considers the time value of money, making it a more dynamic measure of performance. For instance, a higher IRR indicates that returns were achieved more quickly, which is often desirable in venture capital. However, IRR can be sensitive to the timing of cash flows and may not always reflect the true performance of illiquid investments.

How Do MOIC and IRR Complement Each Other?

While MOIC provides a clear measure of absolute returns, IRR offers insights into the efficiency of those returns over time. Together, these metrics provide a more comprehensive view of a VC portfolio's performance. For example, a high MOIC with a low IRR might indicate that returns took longer to materialize, whereas a high IRR with a lower MOIC could suggest quicker but smaller returns. Investors often use both metrics in tandem to assess the overall health of their investments.

What Are the Limitations of MOIC and IRR?

Both MOIC and IRR have their limitations. MOIC does not account for the time value of money, which can lead to misleading conclusions about the efficiency of returns. On the other hand, IRR can be skewed by early exits or large distributions, potentially overstating performance. Additionally, neither metric fully captures the risk profile of investments, which is a critical factor in venture capital. Investors should consider these limitations when relying on MOIC and IRR as primary performance indicators.

See Also How to Best Educate Myself About the Venture Capital Industry

How to Best Educate Myself About the Venture Capital IndustryAre There Other Metrics That Should Be Tracked Alongside MOIC and IRR?

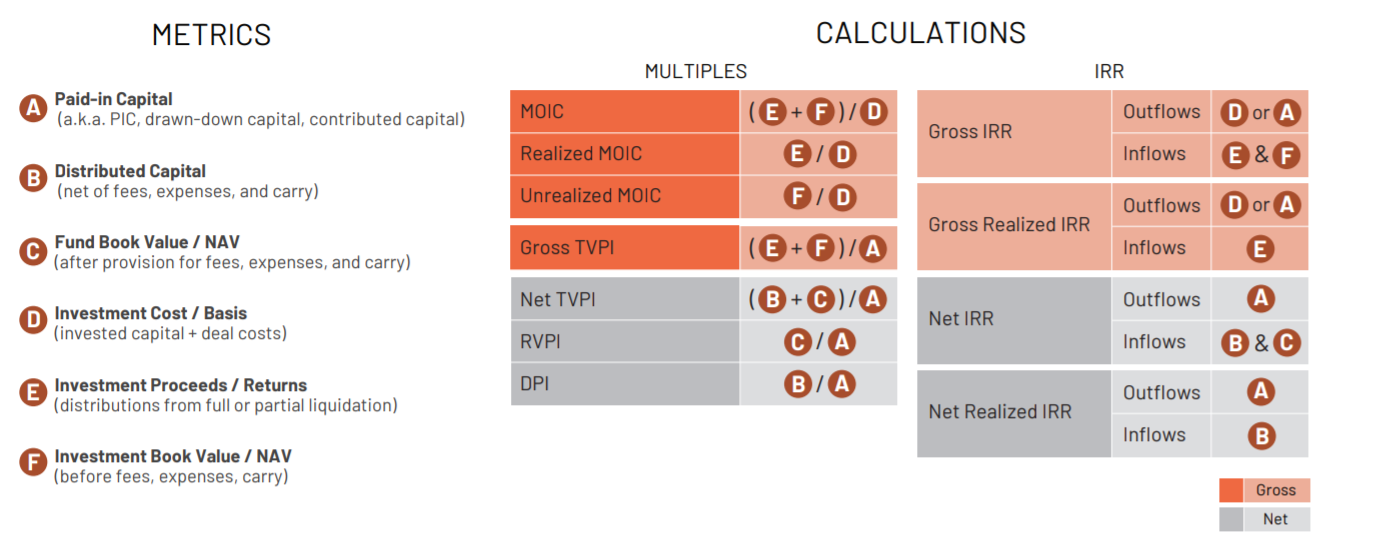

While MOIC and IRR are important, they should not be the only metrics tracked in a VC portfolio. Other key performance indicators include Distributions to Paid-In Capital (DPI), Residual Value to Paid-In Capital (RVPI), and Total Value to Paid-In Capital (TVPI). These metrics provide additional insights into liquidity, unrealized gains, and overall portfolio value. Tracking a combination of these metrics ensures a more holistic understanding of portfolio performance.

| Metric | Description | Key Insight |

|---|---|---|

| MOIC | Measures total returns relative to invested capital | Absolute return without time consideration |

| IRR | Calculates annualized return considering cash flow timing | Efficiency of returns over time |

| DPI | Distributions to Paid-In Capital | Liquidity and realized returns |

| RVPI | Residual Value to Paid-In Capital | Unrealized gains in the portfolio |

| TVPI | Total Value to Paid-In Capital | Overall portfolio value |

Is Moic or IRR more important?

Understanding MOIC and IRR

MOIC (Multiple on Invested Capital) and IRR (Internal Rate of Return) are both critical metrics used in evaluating investment performance. MOIC measures the total return on investment relative to the initial amount invested, while IRR calculates the annualized rate of return, considering the time value of money. Both metrics provide unique insights, but their importance depends on the context of the investment.

See Also What Are the Top Vc Firms and Angel Groups in Seattle Portland Vancouver or Pac Nw Area

What Are the Top Vc Firms and Angel Groups in Seattle Portland Vancouver or Pac Nw Area- MOIC is straightforward and shows the total multiple of the original investment.

- IRR accounts for the timing of cash flows, making it more dynamic.

- Investors often use both metrics together to gain a comprehensive view of performance.

When is MOIC More Important?

MOIC is particularly useful when evaluating investments with a short time horizon or when the timing of cash flows is less critical. It provides a clear picture of the total return without considering the time factor, making it ideal for comparing investments with similar durations.

- Short-term investments benefit more from MOIC analysis.

- It is easier to interpret for non-financial stakeholders.

- MOIC is less sensitive to assumptions about cash flow timing.

When is IRR More Important?

IRR becomes more critical when the timing of cash flows significantly impacts the investment's value. It is especially relevant for long-term projects or investments where cash flows are unevenly distributed over time. IRR helps investors understand the annualized return, making it easier to compare investments with different time horizons.

- Long-term projects require IRR for accurate performance evaluation.

- IRR is essential for assessing the efficiency of capital allocation.

- It is more suitable for investments with irregular cash flows.

Comparing MOIC and IRR in Real-World Scenarios

In real-world scenarios, the choice between MOIC and IRR depends on the specific goals of the investor. For example, private equity firms often prioritize MOIC to showcase total returns to stakeholders, while venture capitalists might focus on IRR to evaluate the growth potential of startups.

See Also How Are Hours Like When You Work for a Vc is There a Work Life Balance

How Are Hours Like When You Work for a Vc is There a Work Life Balance- Private equity often emphasizes MOIC for its simplicity.

- Venture capital relies on IRR to assess high-growth potential.

- Both metrics are complementary and should be used together for a holistic view.

Limitations of MOIC and IRR

Both MOIC and IRR have limitations that investors must consider. MOIC does not account for the time value of money, which can lead to misleading comparisons. IRR, on the other hand, can be distorted by irregular cash flows or reinvestment assumptions, making it less reliable in certain scenarios.

- MOIC ignores the timing of returns, which can be a significant drawback.

- IRR may overstate returns if cash flows are reinvested at unrealistic rates.

- Neither metric alone provides a complete picture of investment performance.

What are 1 or 2 important KPIs for a VC firm?

Internal Rate of Return (IRR)

The Internal Rate of Return (IRR) is one of the most critical KPIs for a VC firm. It measures the profitability of investments over time, providing a percentage that reflects the annualized return. A higher IRR indicates better performance and is often used to compare the success of different funds or investments.

- IRR Calculation: It considers the timing and magnitude of cash flows, making it a comprehensive metric for evaluating investment performance.

- Benchmarking: VC firms often compare their IRR against industry benchmarks to assess their competitiveness.

- Investor Confidence: A strong IRR can attract more investors, as it signals the firm's ability to generate high returns.

Multiple on Invested Capital (MOIC)

The Multiple on Invested Capital (MOIC) is another essential KPI for VC firms. It measures the total value returned to investors relative to the amount of capital invested. A MOIC of 2x, for example, means the firm has doubled the invested capital.

- Simplicity: MOIC is straightforward to calculate and understand, making it a popular metric among investors.

- Performance Indicator: It provides a clear snapshot of how much value has been created from the initial investment.

- Risk Assessment: A high MOIC can indicate successful risk management and strategic investment decisions.

Portfolio Company Growth Rate

The Portfolio Company Growth Rate is a key KPI that tracks the growth trajectory of companies within a VC firm's portfolio. This metric helps assess the scalability and potential of investments.

- Revenue Growth: Monitoring revenue growth helps identify which portfolio companies are scaling effectively.

- Market Expansion: A high growth rate may indicate successful market penetration or expansion strategies.

- Future Potential: Strong growth rates can signal future exits or additional funding rounds, increasing overall returns.

Exit Rate

The Exit Rate measures the frequency and success of portfolio company exits, such as IPOs or acquisitions. This KPI is crucial for evaluating the firm's ability to generate liquidity for investors.

- Liquidity Events: A higher exit rate indicates more opportunities for investors to realize returns.

- Market Timing: Successful exits often depend on the firm's ability to time the market effectively.

- Strategic Exits: Exits through acquisitions or IPOs can significantly enhance the firm's reputation and attract future investments.

Capital Deployment Rate

The Capital Deployment Rate tracks how quickly a VC firm invests its available capital. This KPI is vital for understanding the firm's investment pace and strategy.

- Investment Momentum: A high deployment rate can indicate confidence in the market and a robust deal flow.

- Risk Management: Balancing deployment speed with due diligence is critical to avoid overcommitting to risky investments.

- Fund Cycle: Efficient capital deployment ensures that the firm can raise subsequent funds more easily.

What is a good MOIC for VC fund?

What is MOIC in Venture Capital?

MOIC (Multiple on Invested Capital) is a key performance metric used in venture capital to measure the return on investment. It represents the ratio of the total value of an investment to the amount of capital initially invested. For example, if a VC fund invests $1 million and the investment grows to $3 million, the MOIC is 3x. This metric helps investors understand how much value has been created relative to the capital deployed.

- MOIC is calculated by dividing the current or exit value of an investment by the initial investment amount.

- It is a non-time-weighted metric, meaning it does not account for the duration of the investment.

- MOIC is particularly useful for comparing the performance of early-stage investments where time horizons can vary significantly.

What is Considered a Good MOIC for VC Funds?

A good MOIC for a VC fund typically depends on the stage of investment and the risk profile. For early-stage investments, a MOIC of 3x to 5x is often considered strong, while later-stage investments might aim for a MOIC of 2x to 3x. However, these benchmarks can vary based on market conditions and the specific fund's strategy.

- Early-stage funds often target higher MOICs due to the higher risk and longer time horizons.

- Later-stage funds may accept lower MOICs in exchange for more predictable returns.

- A MOIC of less than 1x indicates a loss, which is common in venture capital due to the high failure rate of startups.

Factors Influencing MOIC in Venture Capital

Several factors can influence the MOIC of a VC fund, including the quality of the portfolio companies, market conditions, and the fund's investment strategy. For instance, a fund that invests in high-growth sectors like technology or healthcare may achieve a higher MOIC compared to one focused on more traditional industries.

- Portfolio diversification can impact MOIC by spreading risk across multiple investments.

- Market timing plays a crucial role, as entering or exiting investments during favorable market conditions can enhance returns.

- The exit strategy, such as IPOs or acquisitions, significantly affects the final MOIC.

How to Calculate MOIC for a VC Fund

Calculating MOIC involves dividing the total value of an investment (current or exit value) by the initial amount invested. For example, if a VC fund invests $2 million in a startup and later sells its stake for $8 million, the MOIC would be 4x. This calculation provides a straightforward measure of investment performance.

- Identify the total invested capital in a specific company or portfolio.

- Determine the current or exit value of the investment.

- Divide the value by the initial investment to obtain the MOIC.

Comparing MOIC with Other VC Metrics

While MOIC is a valuable metric, it is often used alongside other performance indicators like IRR (Internal Rate of Return) and TVPI (Total Value to Paid-In Capital). Unlike MOIC, IRR accounts for the time value of money, providing a more comprehensive view of investment performance over time.

- IRR measures the annualized return, making it useful for comparing investments with different time horizons.

- TVPI combines MOIC with the distribution of returns, offering a broader perspective on fund performance.

- Using multiple metrics together provides a more holistic understanding of a VC fund's success.

What are the four C's of venture capital?

What are the Four C's of Venture Capital?

The Four C's of Venture Capital are a framework used by investors to evaluate potential startups and businesses. These four criteria help assess the viability and potential of an investment opportunity. They are:

- Character: Refers to the integrity, leadership qualities, and trustworthiness of the founding team.

- Capacity: Evaluates the team's ability to execute their business plan and scale the company.

- Capital: Assesses the financial resources available to the startup and its ability to manage funds effectively.

- Collateral: Considers the assets or intellectual property that can serve as security or add value to the business.

Why is Character Important in Venture Capital?

Character is crucial in venture capital because it reflects the moral and ethical foundation of the founding team. Investors look for founders who demonstrate:

- Integrity: Honesty and transparency in business dealings.

- Leadership: The ability to inspire and guide a team toward success.

- Resilience: The capacity to handle challenges and setbacks effectively.

How Does Capacity Influence Investment Decisions?

Capacity is a key factor in determining whether a startup can achieve its goals. Investors evaluate:

- Execution Skills: The team's ability to turn ideas into actionable plans.

- Scalability: The potential to grow the business and expand into new markets.

- Adaptability: The flexibility to pivot or adjust strategies as needed.

What Role Does Capital Play in Venture Capital?

Capital is essential for startups to operate and grow. Investors focus on:

- Funding Needs: The amount of capital required to achieve milestones.

- Financial Management: How effectively the startup manages its resources.

- Runway: The time the startup can operate before needing additional funding.

Why is Collateral Considered in Venture Capital?

Collateral provides a safety net for investors and adds value to the startup. It includes:

- Tangible Assets: Physical assets like equipment or property.

- Intellectual Property: Patents, trademarks, or proprietary technology.

- Market Position: A strong brand or customer base that enhances the startup's value.

Frequently Asked Questions from Our Community

What are MOIC and IRR, and why are they important in venture capital?

MOIC (Multiple on Invested Capital) and IRR (Internal Rate of Return) are two critical financial metrics used in venture capital to evaluate the performance of investments. MOIC measures the total return on an investment relative to the initial amount invested, providing a straightforward view of profitability. For example, a MOIC of 3x means the investment has tripled in value. On the other hand, IRR calculates the annualized rate of return, accounting for the time value of money, which is crucial for understanding how efficiently capital has been deployed over time. Both metrics are essential because they offer complementary insights: MOIC highlights absolute returns, while IRR emphasizes the speed and efficiency of achieving those returns.

Are MOIC and IRR the only metrics that matter in a venture capital portfolio?

While MOIC and IRR are highly important, they are not the only metrics that matter in a venture capital portfolio. Other key indicators include TVPI (Total Value to Paid-In Capital), DPI (Distributions to Paid-In Capital), and RVPI (Residual Value to Paid-In Capital). These metrics provide additional context, such as the liquidity of returns (DPI) or the unrealized potential of ongoing investments (RVPI). Additionally, qualitative factors like the strength of the management team, market trends, and competitive positioning also play a significant role in assessing portfolio performance. Relying solely on MOIC and IRR can lead to an incomplete picture of a portfolio's health.

How do MOIC and IRR differ in their approach to measuring investment performance?

MOIC and IRR differ fundamentally in how they measure investment performance. MOIC is a simple ratio that compares the total value returned to the amount invested, without considering the time it took to achieve those returns. This makes it a useful metric for understanding the absolute growth of an investment. In contrast, IRR incorporates the time factor, calculating the annualized rate of return that equates the present value of cash inflows with the initial investment. This makes IRR particularly valuable for comparing investments with different time horizons. For instance, a high MOIC with a low IRR might indicate a long holding period, whereas a high IRR suggests rapid value creation.

What are the limitations of relying solely on MOIC and IRR for portfolio analysis?

Relying solely on MOIC and IRR for portfolio analysis has several limitations. First, these metrics do not account for the risk profile of investments, which is critical in venture capital where high returns often come with high risk. Second, they may not fully capture the liquidity of returns, as IRR assumes reinvestment of cash flows at the same rate, which may not be realistic. Third, these metrics can be skewed by outliers, such as a single highly successful investment masking underperformance in the rest of the portfolio. Therefore, while MOIC and IRR are valuable, they should be used in conjunction with other metrics and qualitative assessments to gain a comprehensive understanding of portfolio performance.

Leave a Reply

Our Recommended Articles