The health care sector continues to attract significant investment, driven by advancements in biotechnology, digital health, and medical devices. Venture capital (VC) firms play a pivotal role in fueling innovation by funding startups and emerging companies with transformative potential. Among the most active health care-focused VC firms are those that combine deep industry expertise with a strategic vision to identify and nurture groundbreaking solutions. These firms not only provide capital but also offer mentorship, networks, and operational support to help startups scale. This article explores the leading VC firms shaping the future of health care, highlighting their investment strategies and notable contributions to the industry.

- What Are the Most Active Health Care Focused VC Firms?

- What is a healthcare venture capital firm?

- What is a Healthcare Venture Capital Firm?

- How Do Healthcare Venture Capital Firms Operate?

- Why Are Healthcare Venture Capital Firms Important?

- What Types of Companies Do Healthcare Venture Capital Firms Invest In?

- What Are the Challenges Faced by Healthcare Venture Capital Firms?

- What Are the Key Characteristics of Successful Healthcare Venture Capital Firms?

- What is the most successful VC firm?

- What are Tier 1 VCs?

- How to get into healthcare venture capital?

- Frequently Asked Questions from Our Community

What Are the Most Active Health Care Focused VC Firms?

The health care sector has seen significant growth in recent years, driven by advancements in technology, biotechnology, and pharmaceuticals. Venture capital (VC) firms play a crucial role in funding innovative startups and companies in this space. Below, we explore the most active health care-focused VC firms, their investment strategies, and their impact on the industry.

1. Top Health Care VC Firms by Investment Activity

Some of the most active VC firms in the health care sector include Andreessen Horowitz, Khosla Ventures, OrbiMed, New Enterprise Associates (NEA), and ARCH Venture Partners. These firms are known for their substantial investments in biotech, digital health, and medical device companies. They often focus on early-stage startups with high growth potential.

See Also What Types of Insurance Should a Saas Startup Have at Various Revenue Levels?

What Types of Insurance Should a Saas Startup Have at Various Revenue Levels?| VC Firm | Focus Area | Notable Investments |

|---|---|---|

| Andreessen Horowitz | Digital Health, Biotech | Color Genomics, Freenome |

| Khosla Ventures | Biotech, Medical Devices | 23andMe, AliveCor |

| OrbiMed | Biopharma, MedTech | Intarcia Therapeutics, Juno Therapeutics |

2. Investment Trends in Health Care VC

Health care VC firms are increasingly investing in artificial intelligence (AI), telemedicine, and precision medicine. These areas are seen as transformative for the industry, offering solutions to reduce costs, improve patient outcomes, and streamline operations. For example, AI-driven diagnostics and telemedicine platforms have gained significant traction, especially after the COVID-19 pandemic.

3. Geographic Focus of Health Care VC Firms

While many top health care VC firms are based in the United States, particularly in Silicon Valley and Boston, there is growing interest in global markets. Firms like Sequoia Capital China and Sofinnova Partners are actively investing in health care startups across Asia and Europe, respectively. This global expansion reflects the increasing demand for innovative health care solutions worldwide.

4. Key Sectors Within Health Care VC Investments

Health care VC firms typically focus on several key sectors, including biotechnology, pharmaceuticals, medical devices, and digital health. Biotechnology remains a dominant area, with firms investing heavily in gene therapy, immunotherapy, and personalized medicine. Digital health, which includes health tech startups, is also a rapidly growing sector.

See Also What Are Examples of Vc Due Diligence Check Lists?

What Are Examples of Vc Due Diligence Check Lists?5. Challenges Faced by Health Care VC Firms

Despite the opportunities, health care VC firms face challenges such as regulatory hurdles, long development timelines, and high capital requirements. Regulatory approvals for new drugs or medical devices can take years, and the risk of failure is high. Additionally, the capital-intensive nature of the health care industry means that VC firms must be prepared for significant upfront investments.

| Challenge | Impact |

|---|---|

| Regulatory Hurdles | Delays in product approvals |

| Long Development Timelines | Extended time to ROI |

| High Capital Requirements | Increased risk for investors |

What is a healthcare venture capital firm?

What is a Healthcare Venture Capital Firm?

A healthcare venture capital firm is a specialized investment firm that provides funding to early-stage, high-potential companies in the healthcare sector. These firms focus on innovative startups and businesses developing new medical technologies, pharmaceuticals, biotechnology, digital health solutions, and other healthcare-related innovations. By investing in these companies, healthcare venture capital firms aim to generate significant financial returns while also contributing to advancements in medical science and patient care.

See Also What Vc Firms Invest in the Aviation and Aerospace Industry?

What Vc Firms Invest in the Aviation and Aerospace Industry?How Do Healthcare Venture Capital Firms Operate?

Healthcare venture capital firms operate by identifying and investing in startups with high growth potential. Their process typically involves:

- Deal Sourcing: Actively seeking out promising healthcare startups through networking, industry events, and partnerships.

- Due Diligence: Conducting thorough research and analysis to evaluate the viability, scalability, and potential risks of the investment.

- Investment: Providing capital in exchange for equity or ownership stakes in the company.

- Support: Offering strategic guidance, mentorship, and access to industry networks to help the startup grow.

- Exit Strategy: Planning for a profitable exit through an IPO, acquisition, or merger.

Why Are Healthcare Venture Capital Firms Important?

Healthcare venture capital firms play a critical role in driving innovation in the medical field. Their importance can be summarized as follows:

- Funding Innovation: They provide the necessary capital for startups to develop groundbreaking technologies and treatments.

- Risk Mitigation: By investing in multiple companies, they spread risk and increase the chances of successful outcomes.

- Accelerating Growth: Their expertise and resources help startups scale faster and bring products to market more efficiently.

- Improving Patient Outcomes: Investments in healthcare innovations lead to better diagnostic tools, treatments, and overall patient care.

What Types of Companies Do Healthcare Venture Capital Firms Invest In?

Healthcare venture capital firms typically invest in a wide range of companies within the healthcare sector, including:

See Also What Vcs or Angel Investors Are Interested in the Food Industry

What Vcs or Angel Investors Are Interested in the Food Industry- Biotechnology: Companies developing new drugs, gene therapies, or personalized medicine.

- Medical Devices: Startups creating innovative medical equipment or diagnostic tools.

- Digital Health: Businesses focused on telemedicine, health apps, wearable devices, and AI-driven healthcare solutions.

- Pharmaceuticals: Firms working on novel drug formulations or delivery systems.

- Healthcare Services: Companies improving healthcare delivery, patient management, or operational efficiency.

What Are the Challenges Faced by Healthcare Venture Capital Firms?

Despite their critical role, healthcare venture capital firms face several challenges:

- High Risk: Many healthcare startups fail due to regulatory hurdles, clinical trial setbacks, or market competition.

- Long Development Cycles: Bringing healthcare innovations to market often takes years, delaying returns on investment.

- Regulatory Complexity: Navigating FDA approvals and other regulatory requirements can be time-consuming and costly.

- Market Uncertainty: Changes in healthcare policies, reimbursement models, or consumer behavior can impact the success of investments.

What Are the Key Characteristics of Successful Healthcare Venture Capital Firms?

Successful healthcare venture capital firms share several key characteristics:

- Industry Expertise: Deep knowledge of the healthcare sector and its trends.

- Strong Networks: Connections with industry leaders, researchers, and entrepreneurs.

- Patient Capital: Willingness to invest for the long term, understanding the extended timelines of healthcare innovation.

- Strategic Vision: Ability to identify and support startups with transformative potential.

- Risk Management: Effective strategies to mitigate risks and maximize returns.

What is the most successful VC firm?

What Defines the Most Successful VC Firm?

The most successful venture capital (VC) firm is typically defined by its ability to generate high returns on investments, its portfolio of successful companies, and its influence in the startup ecosystem. Key factors include:

- Track Record: Consistently high returns on investments over multiple years.

- Portfolio Strength: A robust portfolio of successful startups and unicorns.

- Reputation: Strong relationships with entrepreneurs, limited partners, and other investors.

Top Contenders for the Most Successful VC Firm

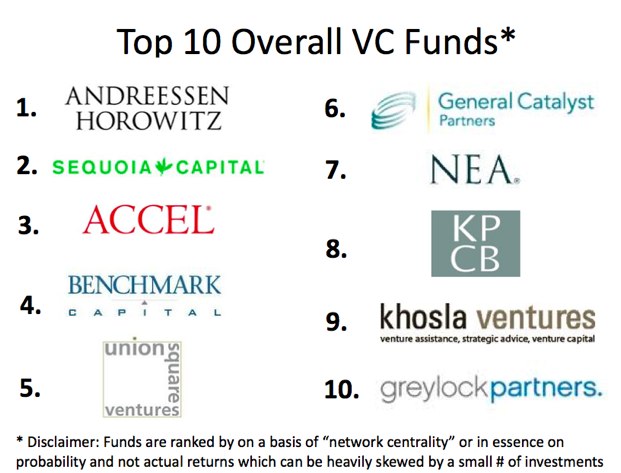

Several VC firms are often considered the most successful due to their impressive track records and influential portfolios. These include:

- Sequoia Capital: Known for early investments in Apple, Google, and Airbnb.

- Andreessen Horowitz: Notable for investments in Facebook, Twitter, and GitHub.

- Accel: Early backers of Facebook, Slack, and Dropbox.

Key Metrics for Evaluating VC Firm Success

To determine the most successful VC firm, certain metrics are crucial. These metrics provide a clear picture of a firm's performance and impact:

- Internal Rate of Return (IRR): Measures the profitability of investments over time.

- Exit Multiples: The return on investment from successful exits like IPOs or acquisitions.

- Fund Size: Larger funds often indicate greater investor confidence and resources.

Impact of Successful VC Firms on the Startup Ecosystem

Successful VC firms play a pivotal role in shaping the startup ecosystem by providing not just capital but also mentorship and strategic guidance. Their impact includes:

- Mentorship: Offering expertise and guidance to portfolio companies.

- Network Access: Connecting startups with industry leaders and potential partners.

- Market Influence: Setting trends and influencing market dynamics through their investments.

Challenges Faced by Top VC Firms

Even the most successful VC firms face challenges that can impact their performance and reputation. These challenges include:

- Market Volatility: Economic downturns can affect investment returns.

- Competition: Increasing competition from new and emerging VC firms.

- Regulatory Changes: Changes in laws and regulations can impact investment strategies.

What are Tier 1 VCs?

Tier 1 VCs refer to the most prestigious and influential venture capital firms in the investment ecosystem. These firms are known for their ability to identify and fund high-potential startups, often leading to significant returns. They typically have a strong track record of successful investments, extensive networks, and substantial financial resources. Tier 1 VCs are often the first choice for entrepreneurs seeking funding due to their reputation and ability to provide not just capital but also strategic guidance and industry connections.

Characteristics of Tier 1 VCs

Tier 1 VCs are distinguished by several key characteristics:

- Proven Track Record: They have a history of successful investments in high-growth companies, often resulting in substantial exits such as IPOs or acquisitions.

- Large Fund Sizes: These firms manage significant amounts of capital, allowing them to make substantial investments in startups across various stages.

- Extensive Networks: Tier 1 VCs have access to a wide range of industry experts, potential partners, and follow-on investors, which can be invaluable for portfolio companies.

Examples of Tier 1 VCs

Some of the most well-known Tier 1 VCs include:

- Sequoia Capital: Known for early investments in companies like Apple, Google, and Airbnb.

- Andreessen Horowitz: A leading firm with investments in Facebook, Twitter, and GitHub.

- Accel: Notable for its early investment in Facebook and other successful tech companies.

Benefits of Securing Funding from Tier 1 VCs

Securing funding from Tier 1 VCs offers several advantages:

- Credibility: Being backed by a Tier 1 VC can significantly enhance a startup's reputation and credibility in the market.

- Strategic Support: These firms often provide mentorship, strategic advice, and operational support to help startups scale effectively.

- Access to Networks: Startups gain access to the VC's extensive network of industry leaders, potential customers, and partners.

Challenges of Working with Tier 1 VCs

While there are many benefits, there are also challenges associated with Tier 1 VCs:

- High Expectations: These firms often have high expectations for growth and returns, which can create pressure on startups.

- Competitive Process: Securing funding from Tier 1 VCs is highly competitive, with many startups vying for limited spots.

- Equity Dilution: Startups may need to give up a significant portion of equity to secure funding from these prestigious firms.

How to get into healthcare venture capital?

Understanding the Healthcare Venture Capital Landscape

To get into healthcare venture capital, it is crucial to first understand the industry's landscape. Healthcare venture capital focuses on investing in innovative startups and companies within the healthcare sector, including biotechnology, pharmaceuticals, medical devices, and digital health. Key steps to familiarize yourself with the landscape include:

- Research the major players, such as top venture capital firms specializing in healthcare.

- Follow industry trends and emerging technologies in healthcare.

- Attend healthcare conferences and networking events to gain insights and build connections.

Building a Strong Educational and Professional Background

A solid foundation in both healthcare and finance is essential for breaking into healthcare venture capital. Consider the following steps to build your expertise:

- Pursue a degree in fields like life sciences, business, or finance.

- Gain experience through internships or roles in healthcare consulting, investment banking, or biotech startups.

- Obtain certifications such as the Chartered Financial Analyst (CFA) or healthcare-specific credentials.

Developing a Network in the Healthcare and Venture Capital Industries

Networking is a critical component of entering healthcare venture capital. Building relationships with professionals in the field can open doors to opportunities. Here’s how to get started:

- Join professional organizations like the National Venture Capital Association (NVCA) or healthcare-focused groups.

- Leverage LinkedIn to connect with venture capitalists, healthcare entrepreneurs, and industry experts.

- Seek out mentors who can provide guidance and introduce you to key players in the industry.

Gaining Hands-On Experience in Healthcare Investing

Practical experience is invaluable for breaking into healthcare venture capital. Consider these steps to gain relevant experience:

- Work in investment roles at venture capital firms, even if they are not exclusively focused on healthcare.

- Participate in startup accelerators or incubators that focus on healthcare innovation.

- Analyze and track the performance of healthcare startups to develop a keen understanding of what makes a successful investment.

Staying Informed and Adapting to Industry Changes

The healthcare industry is constantly evolving, and staying informed is key to success in healthcare venture capital. Here’s how to stay ahead:

- Subscribe to industry publications like STAT News, FierceHealthcare, and MedTech Dive.

- Follow regulatory changes and policy updates that impact healthcare investments.

- Engage in continuous learning through online courses, webinars, and workshops focused on healthcare innovation and venture capital.

Frequently Asked Questions from Our Community

What are the top venture capital firms specializing in health care investments?

Venture capital firms that focus on health care are pivotal in driving innovation in the industry. Some of the most active firms include Andreessen Horowitz, which has a dedicated bio fund, GV (formerly Google Ventures), known for its investments in health tech and life sciences, OrbiMed, a global firm with a strong focus on biopharmaceuticals and medical devices, and Khosla Ventures, which invests in transformative health care technologies. These firms are recognized for their extensive portfolios and strategic investments in startups that aim to revolutionize health care delivery, diagnostics, and treatment.

How do health care-focused VC firms identify promising startups?

Health care-focused venture capital firms employ a rigorous process to identify promising startups. They typically look for companies with innovative solutions that address significant unmet medical needs, have a strong intellectual property portfolio, and demonstrate potential for scalability. Firms often rely on a combination of industry expertise, data analytics, and networking to scout for opportunities. Additionally, they evaluate the founding team's experience, the startup's business model, and the feasibility of its technology or product in the market. This thorough vetting process ensures that only the most viable and impactful startups receive funding.

What sectors within health care do these VC firms typically invest in?

Health care-focused venture capital firms invest across a wide range of sectors, including biotechnology, pharmaceuticals, medical devices, digital health, and health tech. Biotechnology and pharmaceuticals are particularly popular due to the high potential for groundbreaking therapies and treatments. Medical devices and health tech are also significant areas of interest, as they offer innovative solutions for diagnostics, patient monitoring, and treatment delivery. Digital health, which includes telemedicine, health apps, and wearable technology, has seen a surge in investments due to the increasing demand for remote and personalized health care solutions.

What impact do health care-focused VC firms have on the industry?

Health care-focused venture capital firms play a crucial role in shaping the future of the industry. By providing funding and strategic support to startups, they enable the development and commercialization of innovative health care solutions. This not only drives technological advancements but also improves patient outcomes and reduces health care costs. Furthermore, these firms often act as catalysts for industry collaboration, bringing together researchers, entrepreneurs, and established companies to accelerate the pace of innovation. Their investments have led to breakthroughs in areas such as personalized medicine, gene therapy, and artificial intelligence in health care, significantly impacting the way health care is delivered and experienced.

Leave a Reply

Our Recommended Articles