Venture capital (VC) is often glamorized as a high-stakes, high-reward career, offering the thrill of funding groundbreaking startups and reaping substantial returns. However, beneath the surface lies a less-discussed reality filled with challenges and pressures. From the constant stress of making high-risk investment decisions to the emotional toll of dealing with failed ventures, the life of a VC is far from easy. The worst part of being a VC often revolves around the relentless uncertainty, the burden of responsibility, and the personal sacrifices required to succeed in this competitive field. This article delves into the less glamorous aspects of venture capital, shedding light on the hidden struggles that come with the job.

What is the Worst Part of Being a VC?

Being a Venture Capitalist (VC) is often glamorized, but it comes with its own set of challenges. The worst part of being a VC is the high level of uncertainty and risk involved. Unlike traditional investments, VCs invest in early-stage startups, which have a high failure rate. This means that despite thorough due diligence, many investments may not yield returns, leading to significant financial losses. Additionally, the pressure to identify the next big thing in a highly competitive market can be overwhelming. The emotional toll of seeing startups fail, despite the time and resources invested, is another challenging aspect.

The Emotional Toll of Startup Failures

One of the most difficult aspects of being a VC is dealing with the emotional impact of startup failures. VCs often build close relationships with founders and their teams, and when a startup fails, it can feel like a personal loss. The emotional investment in the success of these startups can be draining, especially when multiple investments fail in a short period.

See Also As a New Business What Are the Odds of Getting Venture Capital Funding

As a New Business What Are the Odds of Getting Venture Capital FundingHigh Risk and Uncertainty

The high risk and uncertainty associated with venture capital investments is another significant challenge. VCs invest in startups that are often in their early stages, with unproven business models and markets. This means that the likelihood of failure is high, and even with thorough due diligence, it's impossible to predict which startups will succeed. This uncertainty can lead to significant financial losses and stress.

Pressure to Identify the Next Big Thing

VCs are under constant pressure to identify the next big thing. The venture capital industry is highly competitive, and being able to spot the next unicorn before others do is crucial. This pressure can lead to long hours, intense scrutiny of potential investments, and the fear of missing out on a potentially lucrative opportunity.

Long Investment Horizons

Another challenging aspect of being a VC is the long investment horizons. Unlike other types of investments, venture capital investments can take years, if not decades, to yield returns. This means that VCs must be patient and have the financial stability to wait for their investments to mature, which can be difficult in a fast-paced industry.

See Also Where Can I Find a Searchable Database of Venture Capital Investments by Industry

Where Can I Find a Searchable Database of Venture Capital Investments by IndustryDealing with Founder Conflicts

VCs often have to deal with founder conflicts, which can be both time-consuming and emotionally draining. Startups are often run by passionate, driven individuals who may have differing visions for the company. When conflicts arise, VCs may need to step in to mediate, which can be challenging and stressful.

| Challenge | Description |

|---|---|

| Emotional Toll | Dealing with the emotional impact of startup failures. |

| High Risk | Investing in early-stage startups with high failure rates. |

| Pressure | Constant pressure to identify the next big thing. |

| Long Horizons | Long investment horizons with delayed returns. |

| Founder Conflicts | Mediating conflicts between founders and teams. |

What is bad about venture capitalists?

High Pressure for Rapid Growth

Venture capitalists often push startups to grow at an unsustainable pace to achieve quick returns. This can lead to:

See Also How to Get Sponsors for a Team

How to Get Sponsors for a Team- Burnout among employees due to excessive workloads.

- Compromised product quality as companies rush to meet deadlines.

- Loss of company culture as the focus shifts solely to growth metrics.

Loss of Control for Founders

When venture capitalists invest, they often demand significant equity and decision-making power, which can result in:

- Reduced autonomy for founders in key business decisions.

- Conflicts between investors and founders over the company's direction.

- Potential ousting of founders if they disagree with the investors' vision.

Short-Term Focus Over Long-Term Vision

Venture capitalists typically prioritize short-term gains, which can undermine the company's long-term potential:

- Neglect of innovation in favor of immediate profitability.

- Pressure to exit through an IPO or acquisition, even if it's not the best path for the company.

- Misalignment between the company's mission and investor goals.

High Risk of Failure

Startups backed by venture capitalists face immense pressure to succeed, which can lead to:

See Also Which Angels or Vcs Will Fund Hardware Startups?

Which Angels or Vcs Will Fund Hardware Startups?- Overextension of resources in pursuit of unrealistic goals.

- Increased likelihood of failure due to aggressive scaling strategies.

- Financial instability if the company fails to meet investor expectations.

Equity Dilution and Financial Strain

Accepting venture capital often comes at a high cost for founders and early employees:

- Significant equity dilution, reducing ownership stakes for founders and early team members.

- Financial strain from high expectations for returns on investment.

- Potential loss of future profits as investors take a large share of earnings.

What is the dark side of venture capital?

1. High Pressure and Burnout

Venture capital often comes with intense pressure to deliver rapid growth and returns. Founders and employees may face:

- Unrealistic expectations from investors to achieve exponential growth.

- Long working hours leading to burnout and mental health issues.

- Fear of failure due to the high stakes involved, which can stifle creativity and innovation.

2. Loss of Control and Autonomy

Accepting venture capital often means giving up a significant portion of equity and control. This can result in:

- Investor interference in decision-making processes, potentially derailing the founder's vision.

- Pressure to pivot or change strategies based on investor demands rather than market needs.

- Dilution of ownership, reducing the founder's stake and influence over the company.

3. Short-Term Focus Over Long-Term Vision

Venture capitalists typically seek quick returns on their investments, which can lead to:

- Prioritizing short-term gains over sustainable, long-term growth.

- Neglecting core values or mission in favor of rapid scaling.

- Overemphasis on metrics like user acquisition or revenue, sometimes at the expense of product quality or customer satisfaction.

4. Inequitable Distribution of Wealth

The venture capital model often exacerbates wealth inequality, as it tends to:

- Favor already wealthy investors, who can afford to take high risks.

- Exclude underrepresented founders, such as women and minorities, from accessing funding.

- Concentrate wealth in the hands of a few successful startups, leaving many others struggling or failing.

5. Risk of Overvaluation and Market Bubbles

Venture capital can contribute to inflated valuations and market instability, including:

- Overvaluation of startups based on hype rather than fundamentals, leading to potential crashes.

- Creation of market bubbles in sectors like tech, where excessive funding drives unsustainable growth.

- Misallocation of resources, as capital flows into trendy but unviable business models.

What are the disadvantages of venture capital?

Loss of Control and Ownership

One of the primary disadvantages of venture capital is the loss of control and ownership over your business. When you accept venture capital funding, investors often require a significant equity stake in your company. This can lead to:

- Reduced decision-making power: Investors may demand a seat on the board, influencing key business decisions.

- Dilution of ownership: Founders may end up owning a smaller percentage of their company, reducing their financial upside.

- Pressure to meet investor expectations: Investors may push for rapid growth or exit strategies that may not align with the founder's vision.

High Expectations and Pressure

Venture capitalists typically invest with the expectation of high returns, which can create immense pressure on the business to perform. This can result in:

- Aggressive growth targets: Companies may be forced to scale quickly, sometimes at the expense of long-term stability.

- Focus on short-term gains: The need to deliver quick results can overshadow sustainable business practices.

- Increased stress for founders and employees: The constant pressure to meet milestones can lead to burnout.

Potential for Conflicts

Bringing in venture capital can lead to conflicts between founders and investors, especially if their goals or visions diverge. Common issues include:

- Differences in strategic direction: Investors may push for strategies that prioritize their returns over the company's long-term health.

- Disagreements over resource allocation: Conflicts may arise over how funds are spent or which projects are prioritized.

- Misaligned exit strategies: Founders and investors may have different timelines or methods for exiting the investment.

Dilution of Equity

Accepting venture capital often means diluting your equity, which can have long-term financial implications. Key points include:

- Reduced financial rewards: Founders may receive a smaller share of the profits when the company succeeds.

- Multiple funding rounds: Each round of funding can further dilute equity, leaving founders with a minimal stake.

- Impact on future fundraising: High levels of dilution can make it harder to attract additional investors later.

Risk of Losing the Company

In extreme cases, venture capital funding can lead to the loss of the company itself. This can happen due to:

- Investor takeovers: If the company underperforms, investors may take control to protect their investment.

- Forced exits: Investors may push for a sale or merger, even if it’s not in the founder's best interest.

- Loss of creative freedom: Founders may find their vision compromised as investors steer the company in a different direction.

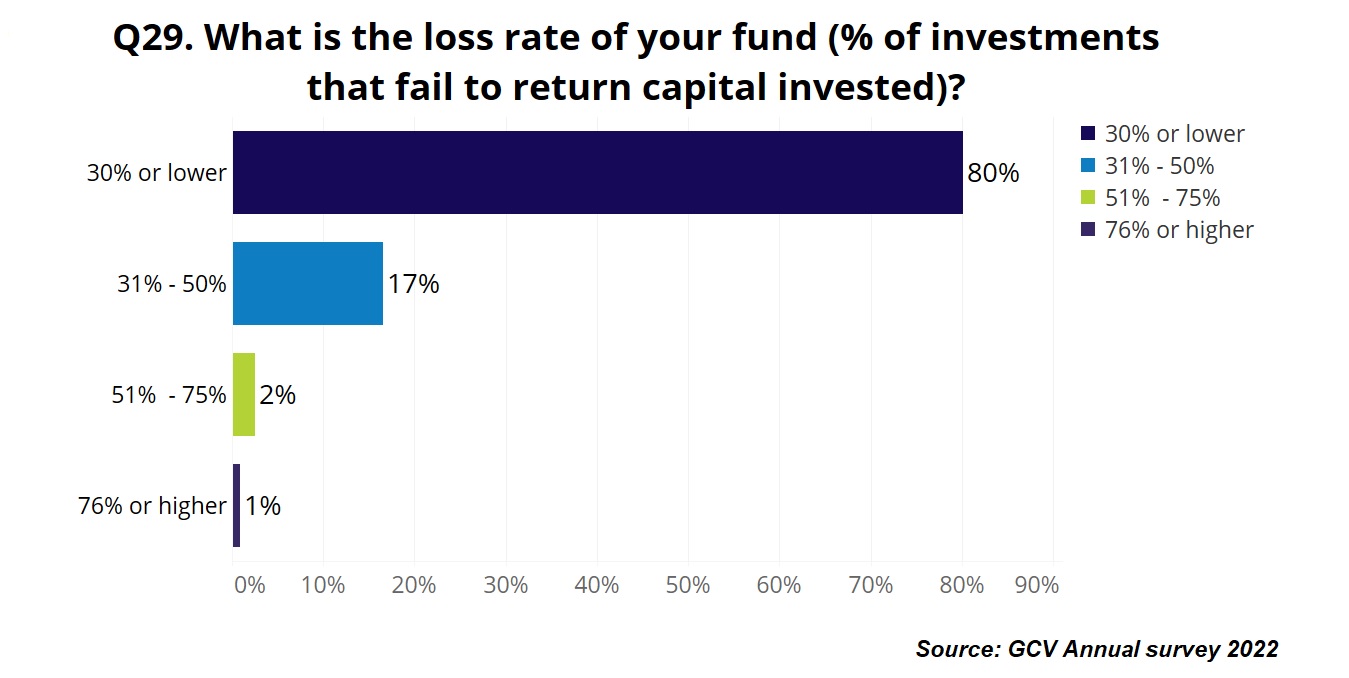

What percent of VC firms fail?

What Percentage of VC Firms Fail?

Approximately 30% to 40% of venture capital (VC) firms fail to return the capital invested by their limited partners (LPs). This failure rate is influenced by various factors, including market conditions, poor investment decisions, and lack of portfolio diversification. While some VC firms achieve significant success, many struggle to sustain profitability over the long term.

Why Do VC Firms Fail?

VC firms fail for several reasons, including:

- Poor Investment Choices: Investing in startups with weak business models or unproven markets.

- Lack of Diversification: Overconcentration in a single industry or stage of investment.

- Market Downturns: Economic recessions or industry-specific downturns that reduce exit opportunities.

- Inexperienced Teams: Lack of expertise in identifying and nurturing high-potential startups.

- High Competition: Intense competition for deals, leading to overvaluation and reduced returns.

How Do VC Firms Measure Success?

VC firms measure success through key performance indicators (KPIs), such as:

- Internal Rate of Return (IRR): A metric that calculates the annualized return on investments.

- Multiple on Invested Capital (MOIC): The total value returned relative to the capital invested.

- Exit Rates: The frequency and size of successful exits, such as IPOs or acquisitions.

- Portfolio Growth: The overall growth and performance of the startups in the portfolio.

- Fundraising Success: The ability to raise subsequent funds from limited partners.

What Are the Risks for Limited Partners in VC Firms?

Limited partners (LPs) face several risks when investing in VC firms, including:

- Capital Loss: The possibility of losing the entire investment if the VC firm fails.

- Illiquidity: VC investments are long-term and cannot be easily liquidated.

- High Fees: Management and performance fees that reduce net returns.

- Dependence on Fund Managers: The success of the investment depends heavily on the VC firm's expertise.

- Market Volatility: Economic or industry-specific changes that impact portfolio performance.

How Can VC Firms Improve Their Success Rate?

VC firms can improve their success rate by:

- Diversifying Investments: Spreading capital across various industries and stages.

- Building Strong Networks: Leveraging connections to source high-quality deals.

- Focusing on Due Diligence: Conducting thorough research before making investments.

- Supporting Portfolio Companies: Providing mentorship and resources to startups.

- Adapting to Market Trends: Staying updated on emerging technologies and industries.

Frequently Asked Questions from Our Community

What is the most challenging aspect of being a venture capitalist?

One of the most challenging aspects of being a venture capitalist is the high level of uncertainty involved in the job. VCs invest in early-stage companies, which often have unproven business models and face significant risks. Despite thorough due diligence, many startups fail, leading to financial losses. Additionally, predicting which companies will succeed is incredibly difficult, requiring a mix of intuition, experience, and luck.

How does the pressure to deliver returns affect venture capitalists?

The pressure to deliver returns to limited partners (LPs) can be immense. Venture capitalists are expected to generate high returns on investment, often within a specific timeframe. This pressure can lead to stressful decision-making and the need to constantly seek out the next big opportunity. Balancing the expectations of LPs with the realities of the market can be a significant source of strain for VCs.

What role does rejection play in the life of a venture capitalist?

Rejection is a constant part of a venture capitalist's life. VCs must frequently say no to entrepreneurs, even when they believe in the team or the idea, simply because the investment doesn't fit their fund's strategy or risk profile. This can be emotionally taxing, as it often involves turning down passionate founders who have poured their hearts into their startups. Additionally, VCs themselves face rejection when competing to invest in the most sought-after deals.

How does the workload and time commitment impact venture capitalists?

The workload and time commitment required to be a successful venture capitalist are substantial. VCs often work long hours, attending meetings, reviewing pitches, conducting due diligence, and networking. The job demands constant availability and the ability to juggle multiple responsibilities simultaneously. This can lead to a lack of work-life balance, making it difficult to maintain personal relationships and hobbies outside of work.

Leave a Reply

Our Recommended Articles